import datetime

import numpy as np

import pandas as pd

import pandas_datareader as pdr

import statsmodels.tsa.stattools as stt

import statsmodels.api as sm

import statsmodels.formula.api as smf

from statsmodels.iolib.summary2 import summary_col

from statsmodels.tsa.arima.model import ARIMA

import scipy as sp

import matplotlib.pyplot as plt

#plt.style.use('ggplot')

plt.style.use('seaborn-v0_8-darkgrid')

import matplotlib.colors as mcolors

np.random.seed(13)

from warnings import simplefilter

simplefilter(action="ignore")25 Introduction to Time Series Regression and Forecasting

25.1 Introduction

In this chapter, we cover the basic concepts of univariate time series methods. We first show how the time series data can be handled in Python using the pandas and pandas_datareader libraries. We then cover basic terminology and concepts, such as lags, leads, differences, growth rates, and annualized growth rates. We define autocorrelation, strict and weak stationarity. We introduce two univariate time series models: the autoregressive (AR) model, and the autoregressive distributed lag (ARDL) model. We specify assumptions under which we can use the OLS estimator for the estimation of these models. We explain how nonstationarity can arise from deterministic and stochastic trends, as well as from structural breaks. We close this chapter with introducing autoregressive moving average (ARMA) models.

Time series data refer to data collected on a single entity at multiple points in time. Some examples are: (i) aggregate consumption and GDP for a country, (ii) annual cigarette consumption per capita in Florida, and (iii) the daily Euro/Dollar exchange rate. In Definition 25.1, we provide a formal definition of time series data.

Definition 25.1 (Time series data) Let \(Y\) denote the time series of interest. The sample data on \(Y\) consist of the realizations of the following process: \[ \{Y_t:\Omega \mapsto \mathbb{R}, t=1,2,\dots\}, \tag{25.1}\]

where \(\Omega\) is some underlying suitable probability space.

According to this definition, \(Y_t\) is the \(t\)-th coordinate of the random variable \(Y\). Thus, a sample of \(T\) observations on \(Y\) is simply the collection \(\{Y_1, Y_2,\dots,Y_T\}\).

From here on, we will consider only consecutive, evenly-spaced observations (for example, quarterly observations from 1962 to 2004, with no missing quarters). Missing and unevenly spaced data introduce complications, which we will not consider in this chapter.

In economics, time series data are often used for (i) forecasting, (ii) estimating dynamic causal effects, and (iii) modeling risk. In forecasting exercises, we place greater emphasis on the model’s goodness-of-fit; however, avoiding overfitting is crucial for generating reliable out-of-sample forecasts. In these exercises, omitted variable bias is not a major concern, as interpreting coefficients is not the primary focus. Instead, external validity is essential because we want the model estimated using historical data to remain applicable in the near future.

25.2 Time series data types in Python

We use pandas and pandas_datareader libraries to work with time series data. We use DataFrame objects in pandas with a time index to store time series data. The data_range function in pandas can be used to generate the time index. Its syntax is as follows:

pd.date_range(start=None, end=None, periods=None, freq= None)where

startandendare the first and last dates in the time index. They can be specified in several formats,start = '1990-05',start = '1990-05-13',end = '02/05/2020','2/5/2020', etc.periodsis the number of observations that are equispaced from the initial to the last, andfreqis the frequency of the observations. It can be'Y'(annual),'QS'(quarterly, quarter start frequency),'QE'(quarterly, quarter end frequency),'M'(monthly),'D'(daily), etc.

As an example, we consider the U.S. quarterly real GDP growth rate over 1960:Q1 to 2017:Q4 from the GrowthRate.csv file. This file contains data on the following variables:

Y: Logarithm of real GDPYGROWTH: Annual real GDP growth rateRECESSION: Recession indicator (1 if recession, 0 otherwise)

We use the read_excel function in pandas to read the data and then use the date_range function to set the time index.

# Load the GDP growth rate data

dfGrowth = pd.read_excel('data/GrowthRate.xlsx', header = 0)

dfGrowth.columns

# Set the index to the date range

dfGrowth.index = pd.date_range(start = '1960', periods=len(dfGrowth), freq = 'QS')

dfGrowth.indexDatetimeIndex(['1960-01-01', '1960-04-01', '1960-07-01', '1960-10-01',

'1961-01-01', '1961-04-01', '1961-07-01', '1961-10-01',

'1962-01-01', '1962-04-01',

...

'2015-07-01', '2015-10-01', '2016-01-01', '2016-04-01',

'2016-07-01', '2016-10-01', '2017-01-01', '2017-04-01',

'2017-07-01', '2017-10-01'],

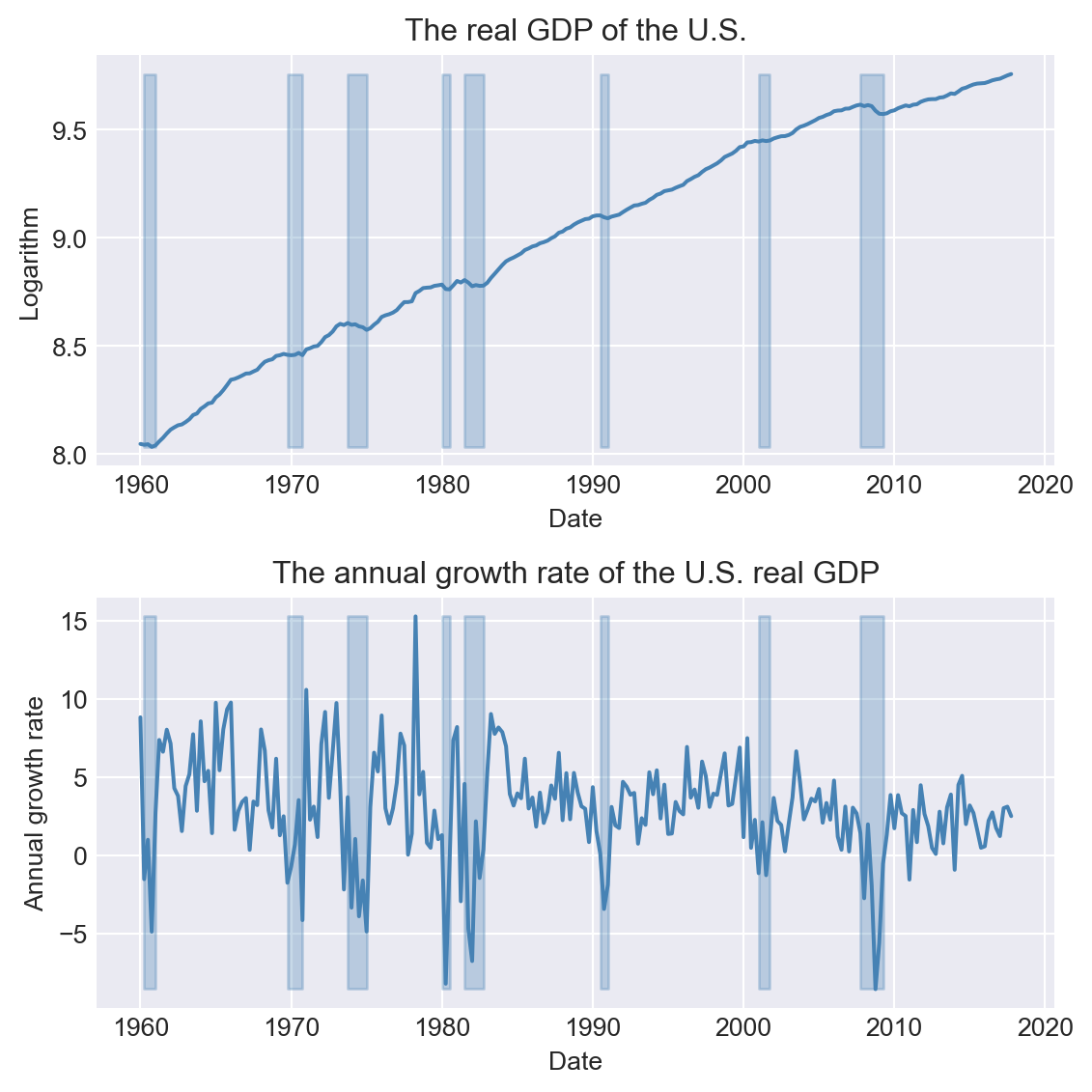

dtype='datetime64[ns]', length=232, freq='QS-JAN')Figure 25.1 shows the time series plot of real GDP and its annual growth rate from 1960 to 2017. The shaded areas in the figure represent recession periods, during which the real GDP growth rate is negative.

# Plot of log GDP and growth rate of GDP

# Create a figure and a set of subplots

fig, axes = plt.subplots(2, 1, figsize=(6, 6))

# Plot log GDP

axes[0].plot(dfGrowth.index, dfGrowth['Y'], linestyle='-', color='steelblue')

axes[0].fill_between(dfGrowth.index, dfGrowth['Y'].min(), dfGrowth['Y'].max(), where=dfGrowth['RECESSION'] == 1, color='steelblue', alpha=0.3)

axes[0].set_title('The real GDP of the U.S.', fontsize=12)

axes[0].set_xlabel('Date', fontsize=10)

axes[0].set_ylabel('Logarithm', fontsize=10)

# Plot of GDP growth rate

axes[1].plot(dfGrowth.index, dfGrowth['YGROWTH'], linestyle='-', color='steelblue')

axes[1].fill_between(dfGrowth.index, dfGrowth['YGROWTH'].min(), dfGrowth['YGROWTH'].max(), where=dfGrowth['RECESSION'] == 1, color='steelblue', alpha=0.3)

axes[1].set_title('The annual growth rate of the U.S. real GDP', fontsize=12)

axes[1].set_xlabel('Date', fontsize=10)

axes[1].set_ylabel('Annual growth rate', fontsize=10)

plt.tight_layout()

plt.show()

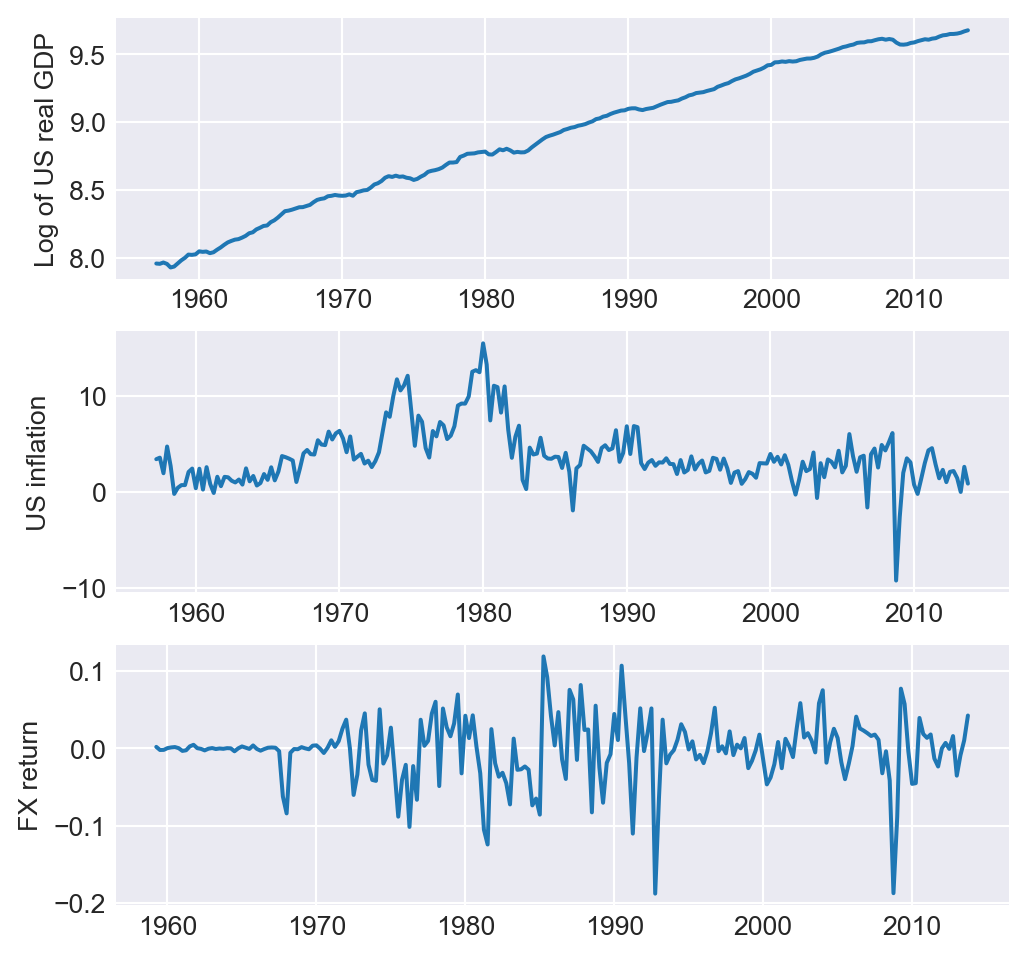

As another example, we consider the quarterly macro economic data on the U.S. contained in the us_macro_quarterly.xlsx file. This file includes quarterly data on several macroeconomic variables from 1957:Q1 to 2013:Q4. The data set contains the following variables:

GDPC96: Real GDPJAPAN_IP: Production of Total Industry in Japan (FRED: JPNPROINDQISMEI)PCECTPI: Personal Consumption Expenditures (Chain-type Price Index)GS10: 10-Year Treasury Constant Maturity Rate (quarterly average of monthly values)GS1: 1-Year Treasury Constant Maturity Rate (quarterly average of monthly values)TB3MS: 3-Month Treasury Bill (Secondary Market Rate, quarterly average of monthly values)UNRATE: Civilian Unemployment Rate (quarterly average of monthly values)EXUSUK: U.S./U.K. Foreign Exchange Rate (quarterly average of daily values)CPIAUCSL: Consumer Price Index for All Urban Consumers: (all items, quarterly average of monthly values)

We use the read_excel function in pandas to read the data set and then use the date_range function to set the time index.

# Load the macroeconomic data set

dfMacro = pd.read_excel('data/us_macro_quarterly.xlsx', header = 0)

dfMacro.columns

# Set the index to the date range

dfMacro.index = pd.date_range(start='1957-01-01', periods=len(dfMacro), freq='QS')

dfMacro.indexDatetimeIndex(['1957-01-01', '1957-04-01', '1957-07-01', '1957-10-01',

'1958-01-01', '1958-04-01', '1958-07-01', '1958-10-01',

'1959-01-01', '1959-04-01',

...

'2011-07-01', '2011-10-01', '2012-01-01', '2012-04-01',

'2012-07-01', '2012-10-01', '2013-01-01', '2013-04-01',

'2013-07-01', '2013-10-01'],

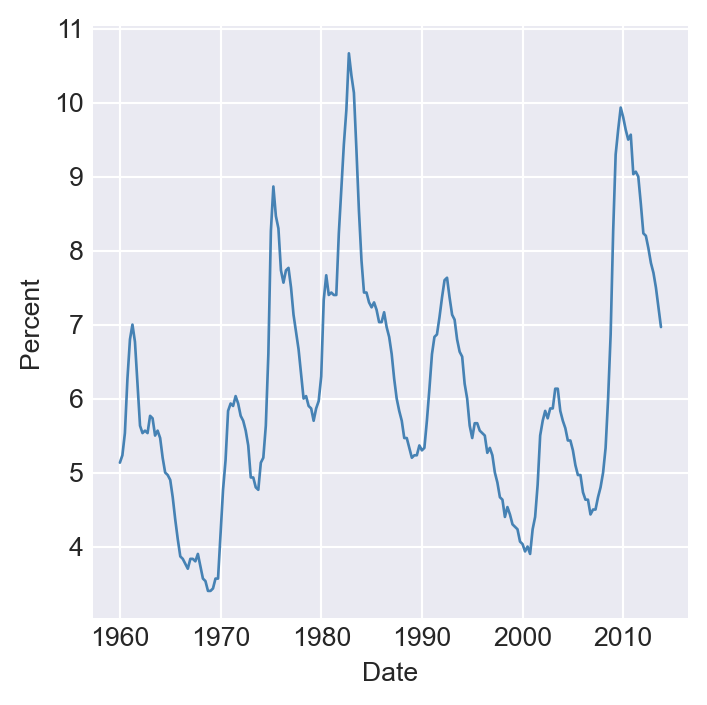

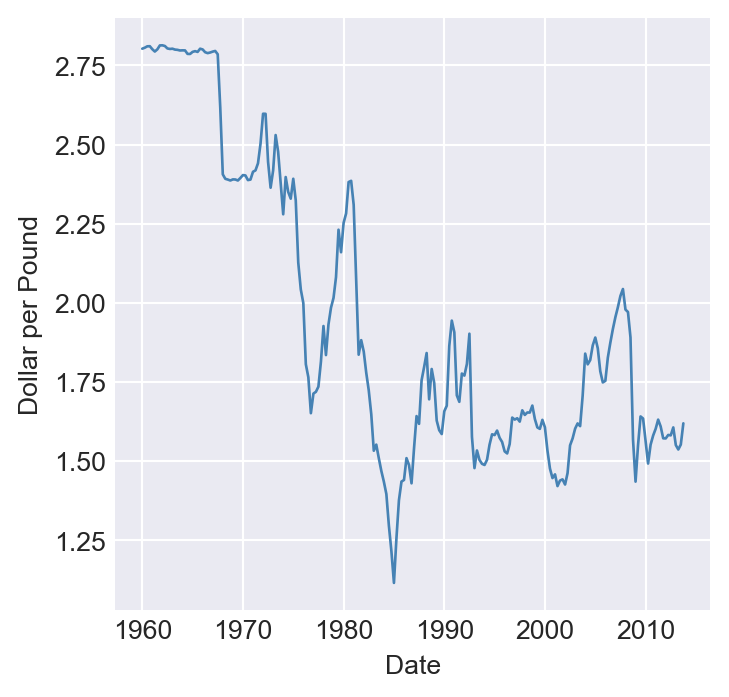

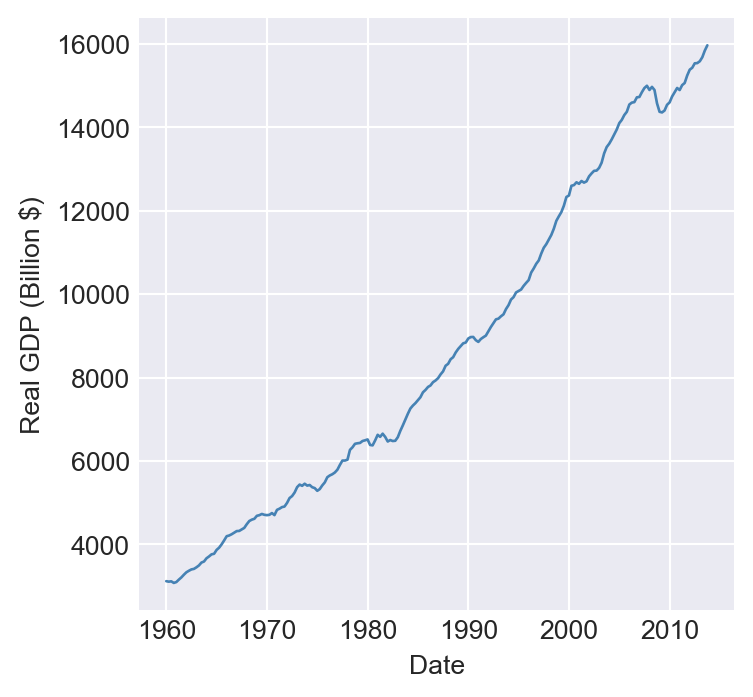

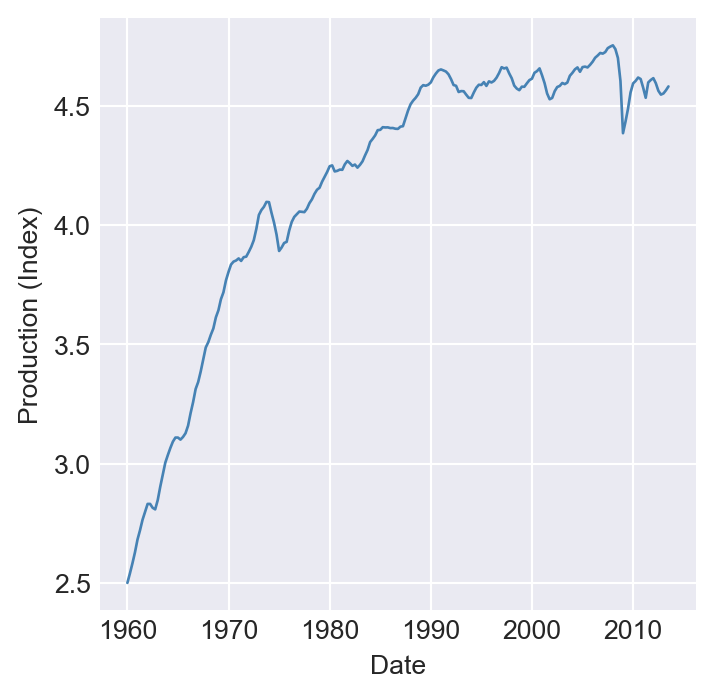

dtype='datetime64[ns]', length=228, freq='QS-JAN')In Figure Figure 25.2, we plot the U.S. unemployment rate, the U.S. dollar/British pound exchange rate, quarterly U.S. real GDP, and the logarithm of Japan’s industrial production index over the period 1960–2013. The figure shows that U.S. real GDP and Japan’s industrial production index exhibit upward trends, while the unemployment rate and the dollar/pound exchange rate fluctuate widely over time.

# Time series plots of four economic variables

# Taking a subset

newdata = dfMacro.loc['1960-01-01':'2013-12-31']

# Plot the U.S. unemployment rate

plt.figure(figsize=(4, 4))

plt.plot(newdata.index, newdata["UNRATE"], color="steelblue", linewidth=1)

plt.ylabel("Percent")

plt.xlabel("Date")

plt.show()

# Plot the U.S. dollar / British pound exchange rate

plt.figure(figsize=(4, 4))

plt.plot(newdata.index, newdata["EXUSUK"], color="steelblue", linewidth=1)

plt.ylabel("Dollar per Pound")

plt.xlabel("Date")

plt.show()

# Plot the U.S. quarterly real GDP

plt.figure(figsize=(4, 4))

plt.plot(newdata.index, newdata["GDPC96"], color="steelblue", linewidth=1)

plt.ylabel("Real GDP (Billion $)")

plt.xlabel("Date")

plt.show()

# Plot the Japanese industrial production index

plt.figure(figsize=(4, 4))

plt.plot(newdata.index, np.log(newdata["JAPAN_IP"]), color="steelblue", linewidth=1)

plt.ylabel("Production (Index)")

plt.xlabel("Date")

plt.show()

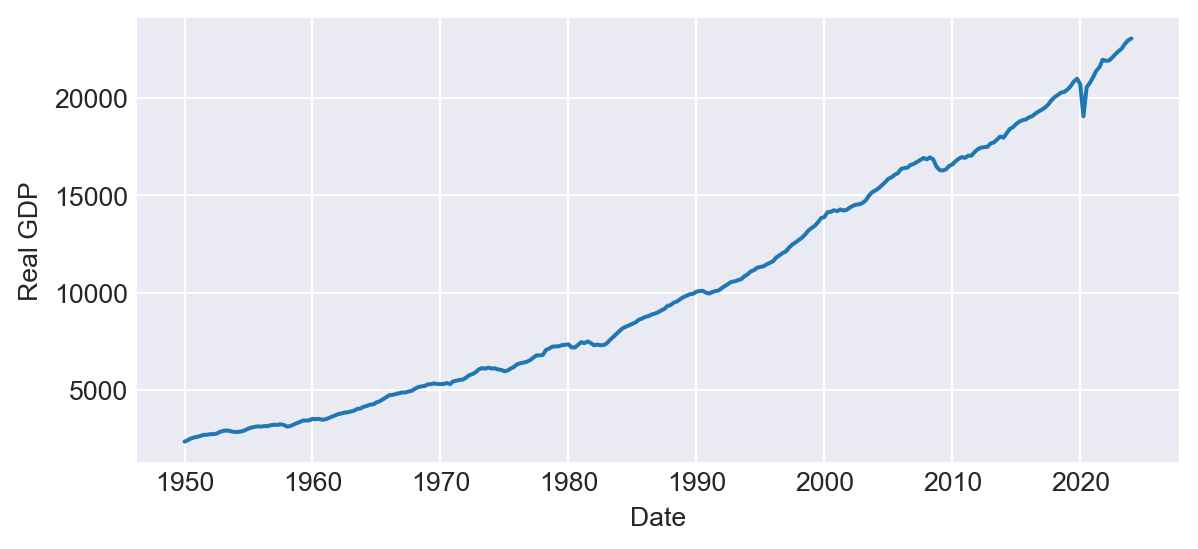

To download time series data from well-known resources, we can use the pandas_datareader library. For further details, see pandas_datareader.data.DataReader. For example, in the following code chunk, we download the U.S. real GDP data from the Federal Reserve Economic Data (FRED) database using the DataReader function in pandas_datareader.

# Download the U.S. real GDP data from FRED

start_date = '1950'

end_date = '2024'

GDP = pdr.data.DataReader('GDPC1', 'fred', start_date, end_date)

fig, ax = plt.subplots(figsize=(7, 3))

ax.plot(GDP.index, GDP['GDPC1'], linestyle='-')

ax.set(xlabel='Date', ylabel='Real GDP')

plt.show()

25.3 Terminology

We need to define some new tools and notations for the analysis of time series data. These include:

- Lags, leads, differences over time.

- Logarithms, growth rates and annualized growth rates.

Definition 25.2 (Lags, leads, differences, growth rates, and annualized growth rates) Let \(\{Y_t\}\) for \(t=1,\ldots,T\) be the time series of interest.

- The first lag of \(Y_t\) is \(Y_{t-1}\); the \(j\)th lag is \(Y_{t-j}\).

- The first lead of \(Y_t\) is \(Y_{t+1}\); the \(j\)th lead is \(Y_{t+j}\).

- The first difference of \(Y_t\) is \(\Delta Y_t = Y_t - Y_{t-1}\).

- The second difference of \(Y_t\) is \(\Delta^2 Y_t = \Delta Y_t - \Delta Y_{t-1}\).

- The one-period growth rate of \(Y\) is given by \(\frac{\Delta Y_t}{Y_{t-1}} = \frac{Y_t - Y_{t-1}}{Y_{t-1}} = \left(\frac{Y_t}{Y_{t-1}}-1\right)\).

- The annualized growth rate of \(Y\) with frequency \(s\) (i.e., annual growth rate if the one period growth rate were compounded) is \[ \left(\left(\frac{Y_t}{Y_{t-1}}\right)^{s} - 1\right). \]

The one-period growth rate of \(Y_t\) from period \(t-1\) to \(t\) defined in Definition 25.2 can be approximated by \(\Delta \ln Y_t\). This approximation is based on the following argument: \[ \begin{align} \Delta \ln Y_t&= \ln\left(\frac{Y_t}{Y_{t-1}}\right) = \ln\left(\frac{Y_{t-1}+\Delta Y_t}{Y_{t-1}}\right)= \ln\left(1+\frac{\Delta Y_t}{Y_{t-1}}\right)\\ &\approx \frac{\Delta Y_t}{Y_{t-1}} = \frac{Y_t - Y_{t-1}}{Y_{t-1}} = \frac{Y_t}{Y_{t-1}} - 1, \end{align} \] where the approximation follows from \(\ln(1+x)\approx x\) when \(x\) is small. Therefore, the annualized growth rate in \(Y_t\) with frequency \(s\) is approximately \(s\times 100 \Delta \ln Y_t\).

In order to calculate lags, leads, and differences over time, we need to set the index of the pandas DataFrame appropriately so that these operations can be performed easily. As an example, we consider the quarterly real GDP time series contained in the GrowthRate.xlsx file.

dfGrowth.columnsIndex(['Period', 'Y', 'YGROWTH', 'RECESSION'], dtype='object')In the following, we compute the first lag and annualized growth rate of the real GDP variable. The annualized percentage growth rate is calculated using the logarithmic approximation: \(4\times100\times\left(\ln(GDP_t)-\ln(GDP_{t-1})\right)=400\times\Delta\ln(GDP_t)\). The results for 2016 and 2017 are given in Table 25.1. For example, the annualized growth rate of the real GDP from 2016:Q4 to 2017:Q1 is \(400\times\left(\ln(16903.24)-\ln(16851.42)\right)=1.23\%\).

# Real GDP

dfGrowth["GDP"] = np.exp(dfGrowth["Y"])

# Annualized growth rate of GDP using the logarithmic approximation

dfGrowth['AnnualRate'] = dfGrowth['Y'].diff() * 400

# First lag of GDP

dfGrowth['GDP_lag1'] = dfGrowth["GDP"].shift(1) # Print data for 2016 and 2017

df_subset = dfGrowth.loc['2016':'2017',:]

df_subset[['GDP', 'Y', 'AnnualRate', 'GDP_lag1']].round(2)| GDP | Y | AnnualRate | GDP_lag1 | |

|---|---|---|---|---|

| 2016-01-01 | 16571.57 | 9.72 | 0.58 | 16547.62 |

| 2016-04-01 | 16663.52 | 9.72 | 2.21 | 16571.57 |

| 2016-07-01 | 16778.15 | 9.73 | 2.74 | 16663.52 |

| 2016-10-01 | 16851.42 | 9.73 | 1.74 | 16778.15 |

| 2017-01-01 | 16903.24 | 9.74 | 1.23 | 16851.42 |

| 2017-04-01 | 17031.09 | 9.74 | 3.01 | 16903.24 |

| 2017-07-01 | 17163.89 | 9.75 | 3.11 | 17031.09 |

| 2017-10-01 | 17271.70 | 9.76 | 2.50 | 17163.89 |

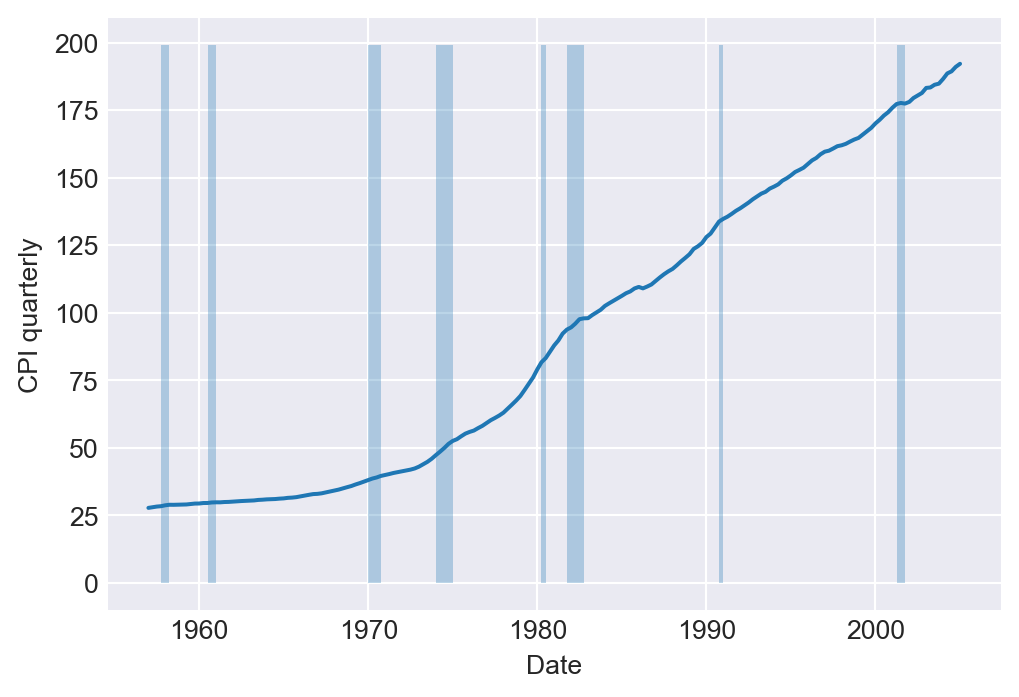

As another example, we consider the quarterly U.S. macroeconomic dataset contained in the macroseries.csv file. We calculate the first lag, the first difference, and the annualized growth rate of the U.S. Consumer Price Index (CPI). Figure 25.4 displays the quarterly U.S. CPI index from 1957 to 2005. The shaded areas indicate recession periods, during which the real GDP growth rate is negative. The figure shows that the index exhibits an upward trend over time, particularly after the 1970s.

# Load the macroeconomic data set

df = pd.read_csv('data/macroseries.csv', header = 0)

# Set the index

df.index = pd.date_range(start = '1957-01-01', periods=len(df), freq = 'QS')

df.columnsIndex(['periods', 'u_rate', 'cpi', 'ff_rate', '3_m_tbill', '1_y_tbond',

'dollar_pound_erate', 'gdp_jp', 't_from_1960', 'recession', 'GS10',

'TB3MS', 'RSPREAD'],

dtype='object')# Plot of the U.S. CPI index

fig, ax = plt.subplots(1, 1, figsize = (6,4))

ax.plot('cpi', data = df, linestyle = '-')

ax.fill_between(df.index, 0, 199, where=(df['recession']==1), alpha=0.3)

ax.set(xlabel = 'Date', ylabel = 'CPI quarterly')

plt.show()

For the CPI variable, we compute lags, differences, and annualized growth rates. The CPI in the first quarter of 2004 (2004:Q1) was \(186.57\), and in the second quarter of 2004 (2004:Q2), it was $188.60. Then, the one-period percentage growth rate of the CPI from 2004:Q1 to 2004:Q2 is

\[ 100\times\left(\frac{188.60-186.57}{186.57}\right)=1.088\%. \]

The annualized growth rate of the CPI (inflation rate) from 2004:Q1 to 2004:Q2 is \(4\times 1.088=4.359\%\). Using the logarithmic approximation, the annualized growth rate of the CPI from 2004:Q1 to 2004:Q2 is \(4\times 100\times(\ln 188.60 - \ln 186.57)=4.329\%\). In Table 25.2, we present the annualized growth rate, the first lag, and the first difference of the CPI for the last five quarters.

# A subset of the U.S. CPI

df['Inf'] = 400*(np.log(df['cpi']) - np.log(df['cpi'].shift(1)))

df['Inf_lag1'] = df['Inf'].shift(1)

df['Delta_Inf'] = df['Inf'] - df['Inf_lag1']

df[['cpi','Inf', 'Inf_lag1', 'Delta_Inf']].tail().round(3)| cpi | Inf | Inf_lag1 | Delta_Inf | |

|---|---|---|---|---|

| 2004-01-01 | 186.567 | 3.806 | 0.867 | 2.939 |

| 2004-04-01 | 188.600 | 4.336 | 3.806 | 0.530 |

| 2004-07-01 | 189.367 | 1.623 | 4.336 | -2.713 |

| 2004-10-01 | 191.033 | 3.505 | 1.623 | 1.882 |

| 2005-01-01 | 192.167 | 2.366 | 3.505 | -1.139 |

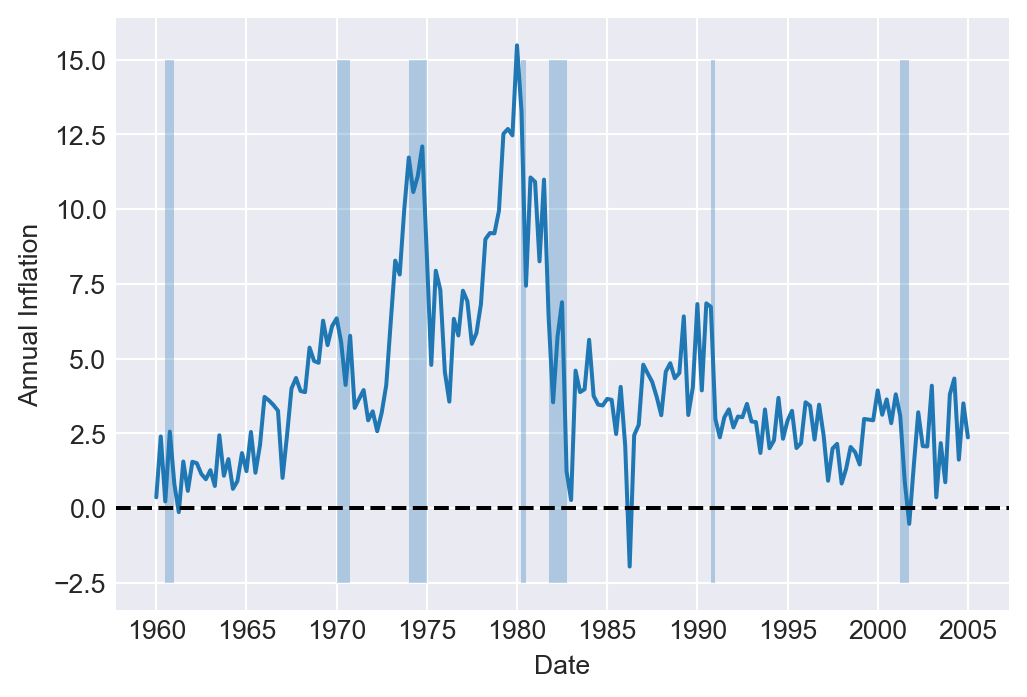

Finally, in Figure 25.5, we plot the U.S. quarterly inflation rate over 1960–2005. The figure shows that inflation fluctuates over time, exhibiting an upward trend until 1980, followed by a decline.

# Plot of U.S. quarterly inflation rate

df_subset = df.loc['1960-01-01':'2005-01-01',:]

fig, ax = plt.subplots(1, 1, figsize = (6,4))

ax.plot('Inf', data = df_subset, linestyle = '-')

ax.axhline(0, linestyle = '--', color = 'black')

ax.fill_between(df_subset.index, -2.5, 15, where=(df_subset['recession']==1), alpha=0.3)

ax.set(xlabel = 'Date', ylabel = 'Annual Inflation')

plt.show()

25.4 Stationarity and autocorrelation

The idea of random sampling from a large population is not suitable for time series data. It is very common for time series data to exhibit correlation over time. Therefore, in order to learn about the distribution \(\{Y_1,\dots,Y_T\}\) (joint, marginals, conditionals) a notion of constancy is needed (Hansen (2022)). Such a notion is stationarity, which is one of the most important concepts in time series analysis. It enables us to use historical relationships to forecast future values, making it a key requirement for ensuring external validity. Intuitively, if a time series is stationary, its future resembles its past in a probabilistic sense.

Definition 25.3 (Strict stationarity) A time series \(Y\) is strictly stationary if its probability distribution does not change over time, i.e., if the joint distribution of \((Y_{s+1},Y_{s+2},\dots,Y_{s+T})\) does not depend on \(s\) regardless of the value of \(T\). Otherwise, \(Y\) is said to be nonstationary. A pair of time series \(Y\) and \(X\) is said to be jointly stationary if the joint distribution of \((X_{s + 1}, Y_{s + 1}, X_{s + 2}, Y_{s + 2},\ldots, X_{s + T}, Y_{s + T})\) does not depend on \(s\) regardless of the value of \(T\).

This definition can be generalized the \(k\)-vector of time series processes. Strict stationarity is a strong assumption as it does not allow for heterogeneity and/or strong persistence. It may also be difficult to observe whether a given time series is stationary by simply examining its time series plot.

Definition 25.4 (Weak stationarity) A time series \(Y\) is weakly stationary if its first and second moments exist and are finite, and they do not change over time. Also, its \(k\)-th autocovariance must only depend on \(k\) regardless of the value of \(T\).

Assume that \(Y\) is weakly stationary such that \(\text{E}(Y_t) = \mu\) and \(\text{var}(Y_t) = \sigma_Y^2\) for all \(t\). It is natural to expect that the leads and lags of \(Y\) are correlated. The correlation of \(Y_t\) with its lag terms is called autocorrelation or serial correlation.

Definition 25.5 (Autocorrelation) The \(k\)-th autocovariance of a series \(Y\) (denoted by \(\gamma(k)\equiv\text{cov}(Y_{t},Y_{t-k})\)) is the covariance between \(Y_t\) and its \(k\)-th lag \(Y_{t-k}\) (or \(k\)-th lead \(Y_{t+k}\)). The \(k\)-th autocorrelation coefficient between \(Y_t\) and \(Y_{t-k}\) is \[ \begin{align*} \rho(k) = \text{corr}(Y_{t},Y_{t-k})=\frac{\gamma(k)}{\sqrt{\text{var}(Y_t)\text{var}(Y_{t-k})}}=\frac{\gamma(k)}{\sigma_Y^2}. \end{align*} \tag{25.2}\]

The \(k\)-th autocorrelation coefficient is also called the \(k\)-th serial correlation coefficient and it is a measure of linear dependence. We can use the sample counterparts of the terms in Definition 25.5 to estimate the autocorrelation coefficients. The sample variance of \(Y\) is given by \[ \begin{align*} s_Y^2 = \frac{1}{T}\sum_{t=1}^T (Y_t - \overline{Y})^2, \end{align*} \]

where \(\overline{Y}\) is the sample average of \(Y\). The \(k\)-th sample autocovariance can be computed as \[ \begin{align*} \widehat{\gamma}(k) = \frac{1}{T}\sum_{t=k+1}^T(Y_t - \overline{Y}_{k+1,T})(Y_{t-k} - \overline{Y}_{1,T-k}), \end{align*} \tag{25.3}\]

where \(\overline{Y}_{k+1,T}\) is the sample average of \(Y\) for \(t=k+1,k+2,\dots,T\). Then, we can estimate the \(\rho(k)\) by the \(k\)th sample autocorrelation (serial correlation), which is given by \[ \begin{align*} \widehat{\rho}(k) = \frac{\widehat{\gamma}(k)}{s_Y^2}. \end{align*} \tag{25.4}\]

In Python, the statsmodels.tsa module contains classes and functions for time-series analysis. For details, see the documentation. The statsmodels.tsa.stattools module contains a variety of functions that are useful for time series analysis, some of which are listed below:

acf(): Compute the autocorrelation function.pacf(): Compute the partial autocorrelation function.adfuller(): Augmented Dickey-Fuller unit root test.

As an example, we compute the sample serial correlations of the U.S. GDP growth rate. The first four sample autocorrelations are \(\hat{\rho}_1 = 0.33\), \(\hat{\rho}_2 = 0.26\), \(\hat{\rho}_3 = 0.10\), and \(\hat{\rho}_4 = 0.11\). These values suggest that GDP growth rates are mildly positively autocorrelated: when GDP grows faster than average in one period, it tends to grow faster than average in the subsequent period as well.

# ACF of the US GDP growth rate

stt.acf(dfGrowth.YGROWTH, nlags=12).round(3)array([ 1. , 0.333, 0.263, 0.102, 0.108, -0.029, 0.019, -0.035,

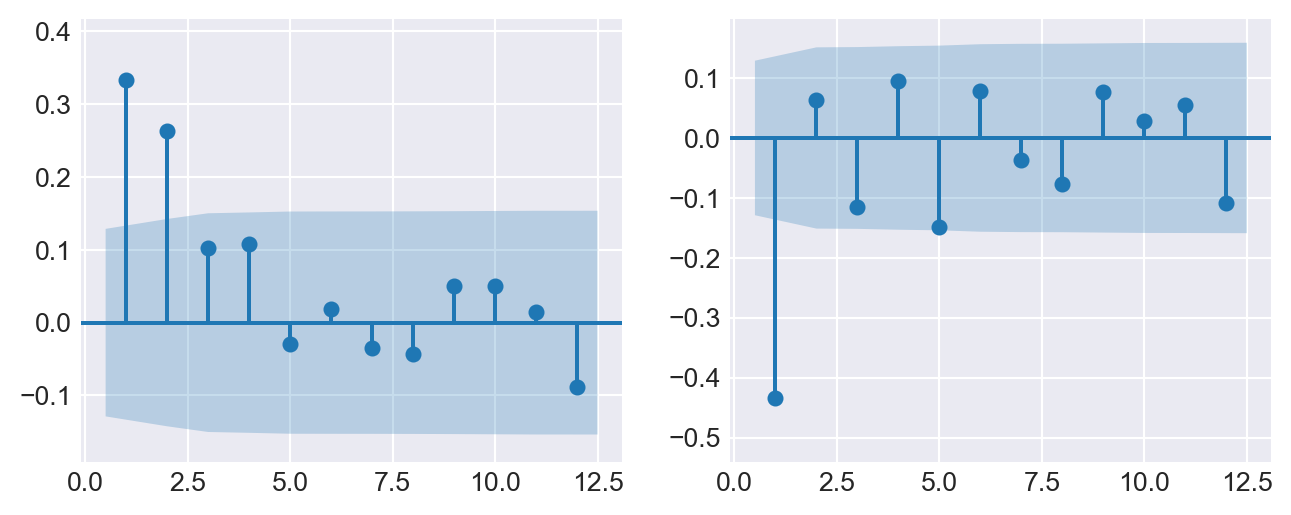

-0.044, 0.051, 0.051, 0.015, -0.089])We use the plot_acf() function to plot the sample serial correlations of the GDP growth rate (up to 12 lags) and its first-differenced version. In Figure 25.6, we observe that the autocorrelation of the GDP growth rate is positive and declines to zero after two lags. In contrast, the autocorrelations of the first-differenced GDP growth rate drop to zero after the first lag.

# Serial correlation of the US GDP growth rate and its first difference

fig, axes = plt.subplots(1, 2, figsize=(8, 3))

sm.graphics.tsa.plot_acf(dfGrowth.YGROWTH, lags=12, zero=False, auto_ylims=True, ax=axes[0], title=None)

sm.graphics.tsa.plot_acf(dfGrowth.YGROWTH.diff().dropna(), lags=12, zero=False, auto_ylims=True, ax=axes[1], title=None)

plt.show()

25.5 Forecast and forecast errors

Forecasting refers to predicting the values of a variable for the near future (out-of-sample). We denote the forecast for period \(T+h\) of a time series \(Y\), based on past observations \(Y_{T}, Y_{T-1}, \ldots\), and using a forecast rule (e.g., the oracle predictor), by \(Y_{T+h|T}\). When the forecast is based on an estimated rule, we denote it by \(\widehat{Y}_{T+h|T}\). Here, \(h\) represents the forecast horizon. When \(h = 1\), \(\widehat{Y}_{T+1|T}\) is called a one-step-ahead forecast; when \(h > 1\), \(\widehat{Y}_{T+h|T}\) is referred to as a multi-step-ahead forecast.

The forecast error is the difference between the actual value of the time series and the forecasted value: \[ \begin{align*} \text{Forecast error} = Y_{T+1} - \widehat{Y}_{T+1|T}. \end{align*} \tag{25.5}\]

To assess the forecast accuracy, we can use the mean squared forecast error (MSFE) and the root mean squared forecast error (RMSFE).

Definition 25.6 (Mean squared forecast error) The mean squared forecast error (MSFE) is \(\text{E}(Y_{T+1} - \widehat{Y}_{T+1|T})^2\), and the square root of the MSFE is called the root mean squared forecast error (RMSFE).

The MSFE and RMSFE can be used to compare the forecast accuracy of different models. There are two sources of randomness in the MSFE: (i) the randomness of the future value \(Y_{T+1}\), and (ii) the randomness of the estimated forecast \(\widehat{Y}_{T+1|T}\). Both randomness contributes to the forecast error. Assume that we use the mean \(\mu_Y\) of \(Y\) as the forecast for \(Y_{T+1}\). In this case, the estimated forecast is \(\widehat{Y}_{T+1|T}=\hat{\mu}_Y\), where \(\hat{\mu}_Y\) is an estimate of \(\mu_Y\). Then, the MSFE can be decomposed as follows: \[ \begin{align*} \text{MSFE} = \text{E}\left(Y_{T+1} - \hat{\mu}_Y\right)^2 = \E(Y_{T+1}-\mu_Y)^2+\E(\mu_Y-\hat{\mu}_Y)^2, \end{align*} \tag{25.6}\] where the second equality follows from the assumption that \(Y_{T+1}\) is uncorrelated with \(\hat{\mu}_Y\). The first term shows the error due to the deviation of \(Y_{T+1}\) from the mean \(\mu_Y\). The second term shows the error due to the deviation of the estimated forecast \(\hat{\mu}_Y\) from the mean \(\mu_Y\).

Definition 25.7 (Oracle forecast) The forecast rule that minimizes the MSFE is the conditional mean of \(Y_{T+1}\) given the in-sample observations \(Y_{1}, Y_{2},\dots,Y_T\), i.e., \(\E(Y_{T+1}|Y_{1}, Y_{2},\dots,Y_T)\). This forecast rule is called the oracle forecast.

The MSFE of the oracle predictor is the minimum possible MSFE. In Section 25.10, we discuss methods for estimating the MSFE and RMSFE in practice.

25.6 Autoregressions

To forecast the future values of the time series \(Y_t\), a natural starting point is to use information available from the history of \(Y_t\). An autoregression (AR) model is a regression in which \(Y_t\) is regressed on its own past values (time lag terms). The number of lags included as regressors is referred to as the order of the regression.

Definition 25.8 (The AR(\(p\)) model) The \(p\)-th order autoregressive (AR(\(p\))) model represents the conditional expectation of \(Y_t\) as a linear function of \(p\) of its lagged values: \[ Y_t = \beta_0+\beta_1 Y_{t-1}+\beta_2Y_{t-2}+\dots+\beta_p Y_{t-p}+u_t, \tag{25.7}\]

where \(\E\left(u_t|Y_{t-1},Y_{t-2}, \dots\right)=0\). The number of lags \(p\) is called the order, or the lag length, of the autoregression.

The coefficients in the AR(\(p\)) model do not have a causal interpretation. For example, if we fail to reject \(H_0:\beta_1=0\), then we will conclude that \(Y_{t-1}\) is not useful for forecasting \(Y_t\).

The property \(\E\left(u_t|Y_{t-1}, Y_{t-2}, \dots\right) = 0\) has two important implications. The first implication is that the error terms \(u_t\)’s are uncorrelated, i.e., \(\text{corr}(u_t,u_{t-k})=0\) for \(k\geq 1\). To see this, we know that if \(\E(u_t|u_{t-1})=0\), then \(\corr(u_t,u_{t-1})=0\) by the law of iterated expectations. The AR(\(p\)) model implies that \[ u_{t-1}=Y_{t-1}-\beta_0-\beta_1 Y_{t-2}-\cdots-\beta_p Y_{t-p-1}=f(Y_{t-1},Y_{t-2},\dots,Y_{t-p-1}), \] where \(f\) indicates that \(u_{t-1}\) is a function of \(Y_{t-1},Y_{t-2},\dots,Y_{t-p-1}\). Then, \(\E(u_t|Y_{t-1},Y_{t-2},\dots)=0\) suggests that \[ \E(u_t|u_{t-1})=\E(u_t|f(Y_{t-1},Y_{t-2},\dots,Y_{t-p-1}))=0. \]

Thus, \(\corr(u_t,u_{t-1})=0\). A similar argument can be made for \(\corr(u_t,u_{t-2})=0\), and so on.

The second implication is that the best forecast of \(Y_{T+1}\) based on its entire history depends on only the most recent \(p\) past values: \[ \begin{align*} &Y_t = \beta_0+\beta_1 Y_{t-1}+\beta_2Y_{t-2}+\dots+\beta_pY_{t-p}+u_t\\ &\implies Y_{T+1} = \beta_0+\beta_1 Y_{T}+\beta_2Y_{T-1}+\dots+\beta_pY_{T-p+1}+u_{T+1}\\ &\implies \underbrace{\E(Y_{T + 1}| Y_1,\dots, Y_{T})}_{Y_{T+1|T}}=\beta_0+\beta_1 Y_{T}+\beta_2Y_{T-1}+\dots+\beta_pY_{T-p+1}. \end{align*} \]

In Python, statsmodels.api.tsa.ar_model.AutoReg, statsmodels.api.tsa.arima.model.ARMA, and statsmodels.api.tsa.arima.model.ARIMA can be utilized for the estimation of AR models. We can also resort the OLS estimator by using statsmodels.formula.api.smf.ols for estimation. In Section 22.8, we specify the assumptions that we need for the estimation of AR models by the OLS estimator.

We use the data set in dfGrowth on the U.S. GDP growth rate over the period 1962:Q1-2017:Q3 to estimate the following AR models: \[

\begin{align}

&\text{GDPGR}_t=\beta_0+\beta_1{\tt GDPGR}_{t-1}+u_t,\\

&\text{GDPGR}_t=\beta_0+\beta_1{\tt GDPGR}_{t-1}+\beta_2{\tt GDPGR}_{t-2}+u_t,

\end{align}

\tag{25.8}\] where \(\text{GDPGR}_t\) denotes the GDP growth rate at time \(t\). We use the OLS estimator with heteroskedasticity-robust standard errors to estimate these models.

# Read the data

mydata = dfGrowth.loc['1962-01-01':'2017-07-01', ['YGROWTH']]

# Create lagged variables for AR(1) and AR(2)

mydata['Ylag1'] = mydata['YGROWTH'].shift(1)

mydata['Ylag2'] = mydata['YGROWTH'].shift(2)

# AR(1) Model

model1 = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1)', data=mydata).fit(vcov_type='HC1')

# model1 = smf.ols(formula='YGROWTH ~ Ylag1', data=mydata[1:]).fit(vcov_type='HC1')

# AR(2) Model

model2 = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1)+ YGROWTH.shift(2)', data=mydata).fit(vcov_type='HC1')

# model2 = smf.ols(formula='YGROWTH ~ Ylag1 + Ylag2', data=mydata).fit(vcov_type='HC1')# Estimation results for the AR(1) and AR(2) models

info_dict = {

'Observations': lambda x: f"{int(x.nobs)}",

'AIC': lambda x: f"{x.aic:.2f}",

'BIC': lambda x: f"{x.bic:.2f}"

}

results_table = summary_col(

[model1, model2],

stars=True,

model_names=['AR(1)', 'AR(2)'],

info_dict=info_dict,

float_format='%0.3f'

)

results_table| AR(1) | AR(2) | |

| Intercept | 1.955*** | 1.608*** |

| (0.278) | (0.305) | |

| YGROWTH.shift(1) | 0.336*** | 0.276*** |

| (0.063) | (0.067) | |

| YGROWTH.shift(2) | 0.176*** | |

| (0.066) | ||

| R-squared | 0.113 | 0.140 |

| R-squared Adj. | 0.109 | 0.133 |

| AIC | 1128.14 | 1119.06 |

| BIC | 1134.94 | 1129.26 |

| Observations | 222 | 221 |

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

The estimation results are presented in Table 25.3. The estimated models are \[ \begin{align} &\widehat{\text{GDPGR}}_t=1.955+0.336{\tt GDPGR}_{t-1},\\ &\widehat{\text{GDPGR}}_t=1.608+0.276{\tt GDPGR}_{t-1}+0.176{\tt GDPGR}_{t-2}. \end{align} \]

Note that we use the sample data over the period 1962:Q1-2017:Q3 to estimate both models. Thus, the last time period in the sample is \(T=2017:Q3\). We want to obtain the forecast of the growth rate in \(T+1=2017:Q4\) based on the estimated AR(\(2\)) model. The estimated model suggests that \[ \begin{align*} \text{GDPGR}_{2017:Q4|2017:Q3} &= 1.61 + 0.28 \text{GDPGR}_{2017:Q3} + 0.18 \text{GDPGR}_{2017:Q2}\\ & = 1.61 + 0.28\times 3.11 + 0.18 \times 3.01\approx3.0. \end{align*} \] Since the actual growth rate in 2017:Q4 is \(2.5\%\), the forecast error is \(2.5\% - 3.0\% = -0.5\) percentage points.

We used the smf.ols() function to estimate the AR(\(1\)) and AR(\(2\)) models for the GDP growth rate above. Below, we use the ARIMA function from the statsmodels.tsa.arima.model module to estimate the AR(\(1\)) and AR(\(2\)) models for the GDP growth rate. In the ARIMA function, the order of the model is specified as (p, d, q), where p is the order of the autoregressive part, d is the order of differencing, and q is the order of the moving average part. Note that although the estimated coefficients are the same as those presented in Table 25.3, the standard errors are different because the ARIMA function does not use the heteroskedasticity-robust standard errors.

# Read the data

mydata = dfGrowth.loc['1962-01-01':'2017-07-01', ['YGROWTH']]

# Drop missing values to ensure compatibility with ARIMA models

mydata = mydata.dropna()

# AR(1) Model

ar1_model = ARIMA(mydata['YGROWTH'], order=(1, 0, 0)).fit()

# AR(2) Model

ar2_model = ARIMA(mydata['YGROWTH'], order=(2, 0, 0)).fit()

# Summary of models

print("AR(1) Model Summary:")

print(ar1_model.summary())

print("\nAR(2) Model Summary:")

print(ar2_model.summary())AR(1) Model Summary:

SARIMAX Results

==============================================================================

Dep. Variable: YGROWTH No. Observations: 223

Model: ARIMA(1, 0, 0) Log Likelihood -564.997

Date: Wed, 26 Nov 2025 AIC 1135.995

Time: 08:51:15 BIC 1146.216

Sample: 01-01-1962 HQIC 1140.121

- 07-01-2017

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 2.9796 0.311 9.585 0.000 2.370 3.589

ar.L1 0.3365 0.055 6.141 0.000 0.229 0.444

sigma2 9.2890 0.611 15.209 0.000 8.092 10.486

===================================================================================

Ljung-Box (L1) (Q): 0.82 Jarque-Bera (JB): 43.19

Prob(Q): 0.37 Prob(JB): 0.00

Heteroskedasticity (H): 0.37 Skew: -0.05

Prob(H) (two-sided): 0.00 Kurtosis: 5.15

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

AR(2) Model Summary:

SARIMAX Results

==============================================================================

Dep. Variable: YGROWTH No. Observations: 223

Model: ARIMA(2, 0, 0) Log Likelihood -561.492

Date: Wed, 26 Nov 2025 AIC 1130.985

Time: 08:51:15 BIC 1144.613

Sample: 01-01-1962 HQIC 1136.487

- 07-01-2017

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 2.9876 0.375 7.967 0.000 2.253 3.723

ar.L1 0.2773 0.057 4.845 0.000 0.165 0.389

ar.L2 0.1758 0.057 3.065 0.002 0.063 0.288

sigma2 8.9989 0.576 15.629 0.000 7.870 10.127

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 56.16

Prob(Q): 0.98 Prob(JB): 0.00

Heteroskedasticity (H): 0.36 Skew: 0.04

Prob(H) (two-sided): 0.00 Kurtosis: 5.46

===================================================================================

Warnings:

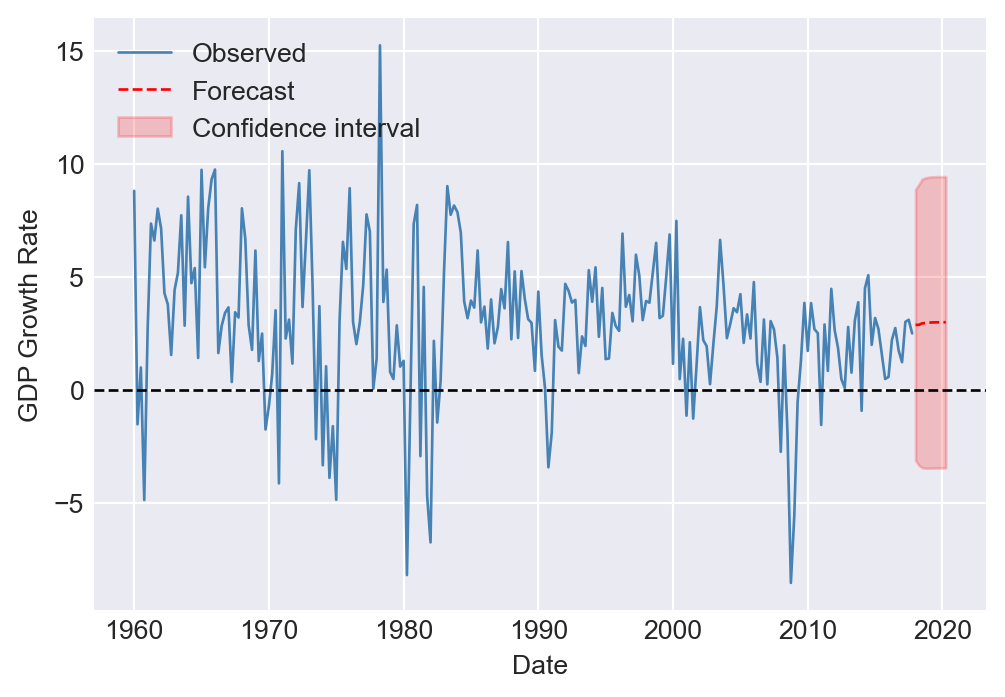

[1] Covariance matrix calculated using the outer product of gradients (complex-step).We can also use the ARIMA() function to generate forecasts. For example, we can generate 10-step-ahead forecast for the GDP growth rate. The forecasted growth rates are presented in Table 25.4 and Figure 25.7. The table also includes the 95% forecast intervals for the forecasted growth rates. We discuss how to construct the forecast intervals in Section 25.10.

# Read the data

GrowthGDP = dfGrowth["YGROWTH"]

# Fit the ARIMA model

model = ARIMA(GrowthGDP, order=(2, 0, 0))

m1 = model.fit()

# Forecast with confidence intervals

forecast_horizon = 10

forecast = m1.get_forecast(steps=forecast_horizon)

forecast_mean = forecast.predicted_mean

conf_int = forecast.conf_int(alpha=0.05) # 95% confidence interval (example)

# Create dataframe

forecast_df = pd.DataFrame({

"Forecast": forecast_mean,

"Lower": conf_int.iloc[:, 0],

"Upper": conf_int.iloc[:, 1]

})

forecast_df| Forecast | Lower | Upper | |

|---|---|---|---|

| 2018-01-01 | 2.880326 | -3.111557 | 8.872209 |

| 2018-04-01 | 2.882656 | -3.335474 | 9.100785 |

| 2018-07-01 | 2.946846 | -3.443682 | 9.337374 |

| 2018-10-01 | 2.965045 | -3.462630 | 9.392721 |

| 2019-01-01 | 2.980949 | -3.461819 | 9.423718 |

| 2019-04-01 | 2.988439 | -3.458759 | 9.435637 |

| 2019-07-01 | 2.993206 | -3.455530 | 9.441941 |

| 2019-10-01 | 2.995795 | -3.453431 | 9.445020 |

| 2020-01-01 | 2.997319 | -3.452070 | 9.446707 |

| 2020-04-01 | 2.998179 | -3.451262 | 9.447621 |

# Plot the forecasted growth rates

plt.figure(figsize=(6, 4))

plt.plot(GrowthGDP, label="Observed", color="steelblue", linewidth=1)

plt.plot(forecast_mean, label="Forecast", color="red", linestyle="--", linewidth=1)

plt.fill_between(

forecast_mean.index,

conf_int.iloc[:, 0],

conf_int.iloc[:, 1],

color="red",

alpha=0.2,

label="Confidence interval"

)

plt.xlabel("Date", fontsize=10)

plt.ylabel("GDP Growth Rate", fontsize=10)

plt.axhline(y=0, color="black", linestyle="--", linewidth=1)

plt.legend(loc="upper left", fontsize=10, frameon=False)

plt.show()

In the next example, we use the data set in macroseries.csv to estimate the AR(\(1\)) and AR(\(4\)) models for the change in the U.S. inflation rate.

# AR(1) and AR(4) models for the change U.S. inflation rate

df['L1_Delta_Inf'] = df['Delta_Inf'].shift(1)

df['L2_Delta_Inf'] = df['Delta_Inf'].shift(2)

df['L3_Delta_Inf'] = df['Delta_Inf'].shift(3)

df['L4_Delta_Inf'] = df['Delta_Inf'].shift(4)

df_subset = df.loc['1962-01-01':'2004-10-01',:]

AR_1 = smf.ols(formula = 'Delta_Inf ~ L1_Delta_Inf',

data = df_subset).fit(cov_type='HC1')

AR_4 = smf.ols(formula = 'Delta_Inf ~ L1_Delta_Inf + L2_Delta_Inf + L3_Delta_Inf + L4_Delta_Inf', data = df_subset).fit(cov_type='HC1')# Present the models using summary_col

info_dict = {'N':lambda x: "{0:d}".format(int(x.nobs)),

'AIC':lambda x: "{:.2f}".format(x.aic),

'BIC':lambda x: "{:.2f}".format(x.bic),

}

results_table = summary_col([AR_1, AR_4], stars=True, model_names=['AR(1)', 'AR(4)'], info_dict=info_dict, float_format='%0.3f')

results_table| AR(1) | AR(4) | |

| Intercept | 0.017 | 0.022 |

| (0.127) | (0.118) | |

| L1_Delta_Inf | -0.238** | -0.258*** |

| (0.097) | (0.093) | |

| L2_Delta_Inf | -0.322*** | |

| (0.081) | ||

| L3_Delta_Inf | 0.158* | |

| (0.084) | ||

| L4_Delta_Inf | -0.030 | |

| (0.093) | ||

| R-squared | 0.056 | 0.204 |

| R-squared Adj. | 0.051 | 0.185 |

| AIC | 665.27 | 642.05 |

| BIC | 671.56 | 657.78 |

| N | 172 | 172 |

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

The estimation results are presented in Table 25.5. The estimated AR(\(1\)) model is \[ \widehat{\Delta \text{inf}}_t = 0.017 - 0.238 \Delta \text{inf}_{t-1}. \]

The coefficient estimate for the lag of the change in inflation is \(-0.238\) and it is statistically significant at the conventional levels. In the dataset, the inflation rate for 2004:Q3 is 1.6 and for 2004:Q4 is 3.5. Hence, \(\Delta \text{inf}_{\text{2004:Q4}}=3.5-1.6=1.9\). Then, \(\widehat{\Delta \text{inf}}_{\text{2005:Q1}}=0.017 - 0.238\times 1.9 = -0.4352\) and \(\widehat{\text{inf}}_{\text{2005:Q1}}=-0.4352 + 3.5 = 3.0648\).

The estimated AR(4) model for the change in inflation is \[ \widehat{\Delta \text{inf}}_t = 0.022 - 0.258 \Delta \text{inf}_{t-1} - 0.322 \Delta \text{inf}_{t-2} + 0.158 \Delta \text{inf}_{t-3} - 0.030 \Delta \text{inf}_{t-4}. \]

We observe that the fit of the model improves significantly compared to the AR(\(1\)) model, as indicated by an increase in the adjusted R-squared to 0.185. Furthermore, in the AR(\(4\)) model, the additional time lag terms are jointly statistically significant, as shown by the \(F\)-test result below.

hypotheses = ['L2_Delta_Inf=0', 'L3_Delta_Inf=0', 'L4_Delta_Inf=0']

ftest = AR_4.f_test(hypotheses)

print(ftest)<F test: F=6.70644043665371, p=0.00026659957882544007, df_denom=167, df_num=3>25.7 Autoregressive distributed lag model

In AR models, we use only the lagged values of the dependent variable \(Y\) as predictors. However, if there are other variables that may help in predicting \(Y\), we can incorporate them into the regression model. The autoregressive distributed lag (ADL) model is such a model. It includes lags of both the dependent variable \(Y\) and other explanatory variables as predictors.

Definition 25.9 (Autoregressive distributed lag model) The autoregressive distributed lag model with \(p\) lags of \(Y_t\) and \(q\) lags of \(X_t\), denoted ADL(\(p,q\)), is \[ Y_t = \beta_0 + \beta_1 Y_{t-1} + \dots + \beta_p Y_{t-p}+ \delta_1 X_{t-1}+\dots+ \delta_q X_{t-q}+u_t, \tag{25.9}\]

where \(\beta_0, \beta_1,\dots,\beta_p, \delta_1,\dots,\delta_q\), are unknown coefficients and \(u_t\) is the error term with \(\E\left(u_t|Y_{t-1}, Y_{t-2},\dots, X_{t-1}, X_{t-2},\dots\right) = 0\).

The assumption \(\E\left(u_t|Y_{t-1}, Y_{t-2},\dots, X_{t-1}, X_{t-2},\dots\right) = 0\) suggests that the error terms \(u_t\)’s are serially uncorrelated. Moreover, it indicates that the lag lengths \(p\) and \(q\) are correctly specified, such that the coefficients of lag terms beyond \(p\) and \(q\) are zero.

If there are multiple predictors \(X_1,\ldots,X_k\), then the ADL model defined in Definition 25.9 can be extended as follows:

\[

\begin{align}

Y_t &= \beta_0 + \beta_1Y_{t-1} + \beta_2Y_{t-2} +\ldots+ \beta_pY_{t-p}\nonumber\\

&+\delta_{11}X_{1t-1} + \delta_{12}X_{1t-2} + \ldots+\delta_{1q_1}X_{1t-q_1}\nonumber\\

&+\ldots+\delta_{k1}X_{kt-1} + \delta_{k2}X_{kt-2} + \ldots+\delta_{kq_k}X_{kt-q_k}+u_t,

\end{align}

\tag{25.10}\]

where \(q_1\) lags of the first predictor, \(q_2\) lags of the second predictor, and so forth are included in the model.

In the following ADL(\(2,1\)) and ADL(\(2,2\)) models, we consider the U.S. term spread (TSpread) as an additional predictor for the GDP growth rate. \[

\begin{align*}

&\text{GDPGR}_t=\beta_0+\beta_1{\tt GDPGR}_{t-1}+\beta_2{\tt GDPGR}_{t-2}+\delta_1{\tt TSpread}_{t-1}+u_t,\\

&\text{GDPGR}_t=\beta_0+\beta_1{\tt GDPGR}_{t-1}+\beta_2{\tt GDPGR}_{t-2}+\delta_1{\tt TSpread}_{t-1}+\delta_2{\tt TSpread}_{t-2}+u_t,

\end{align*}

\tag{25.11}\] where TSpread is the term spread, measured as the difference between the 10-year Treasury bond rate (the long-term interest rate) and the 3-month Treasury bill rate (the short-term interest rate).

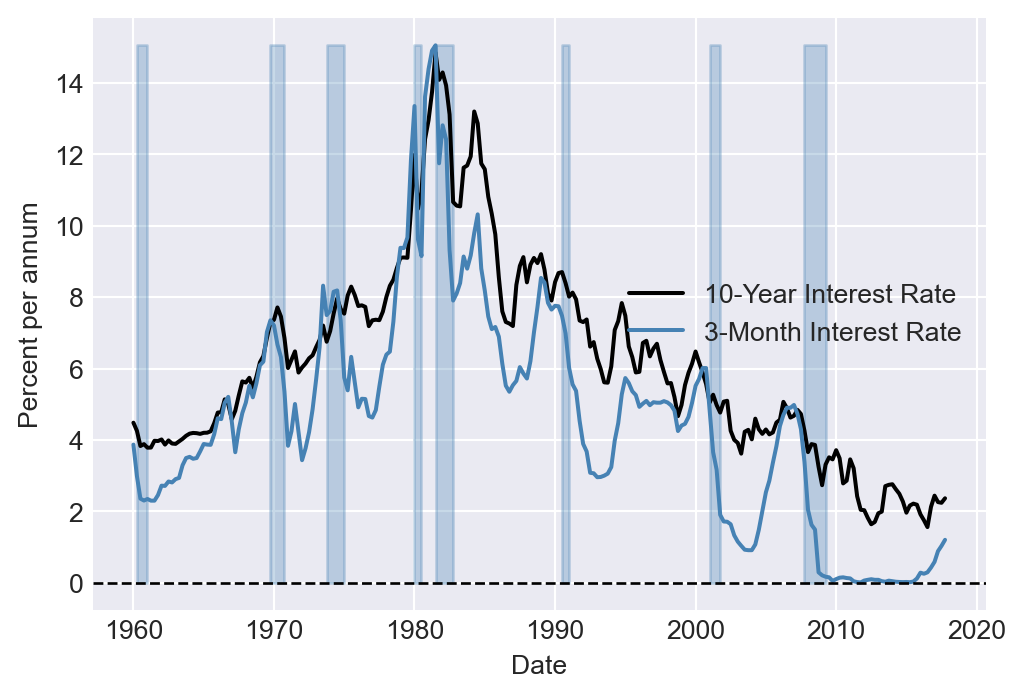

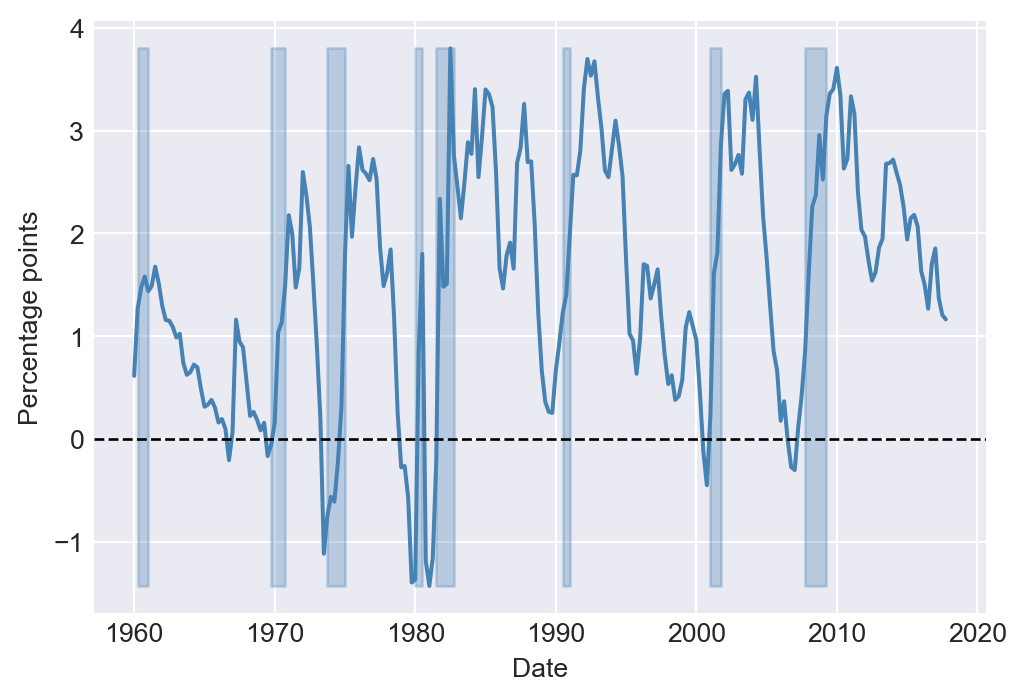

We use the dataset provided in the TermSpread.csv file to estimate these models. In Figure 25.8, we plot the U.S. long-term and short-term interest rates. The figure shows that both interest rates tend to move together over time. Figure 25.9 displays the term spread, which is generally positive and tends to decline before the recession periods. This observation suggests that the term spread may serve as a useful predictor for the GDP growth rate.

# Read the term spread data

dfTermSpread = pd.read_csv('data/TermSpread.csv', header = 0)

dfTermSpread.index = pd.date_range(start = '1960-01-01', periods=len(dfTermSpread), freq = 'QS')

dfTermSpread.columnsIndex(['Period', 'GS10', 'TB3MS', 'RSPREAD', 'RECESSION'], dtype='object')# Long-term and short-term interest rates in the US

# Plot the long-term and short-term interest rates

plt.figure(figsize=(6, 4))

plt.plot(dfTermSpread.index, dfTermSpread['GS10'], label='10-Year Interest Rate', color='black', linewidth=1.5)

plt.plot(dfTermSpread.index, dfTermSpread['TB3MS'], label='3-Month Interest Rate', color='steelblue', linewidth=1.5)

plt.fill_between(dfTermSpread.index, 0, dfTermSpread['TB3MS'].max(), where=dfTermSpread['RECESSION'] == 1, color='steelblue', alpha=0.3)

plt.axhline(0, linestyle='--', color='black', linewidth=1)

plt.xlabel('Date', fontsize=10)

plt.ylabel('Percent per annum', fontsize=10)

plt.legend(fontsize=10)

plt.show()

# Plot the term spread

plt.figure(figsize=(6, 4))

plt.plot(dfTermSpread.index, dfTermSpread['RSPREAD'], label='Term Spread', color='steelblue', linewidth=1.5)

plt.fill_between(dfTermSpread.index, dfTermSpread['RSPREAD'].min(), dfTermSpread['RSPREAD'].max(), where=dfTermSpread['RECESSION'] == 1, color='steelblue', alpha=0.3)

plt.axhline(0, linestyle='--', color='black', linewidth=1)

plt.xlabel('Date', fontsize=10)

plt.ylabel('Percentage points', fontsize=10)

plt.show()

We use the following code chunk to estimate the ADL(\(2,1\)) and ADL(\(2,2\)) models. The estimation results are presented in Table 25.6. The estimated models are \[ \begin{align} &\widehat{\text{GDPGR}}_t=0.95+0.27{\tt GDPGR}_{t-1}+0.19{\tt GDPGR}_{t-2}+0.42{\tt TSpread}_{t-1},\\ &\widehat{\text{GDPGR}}_t=0.95+0.24{\tt GDPGR}_{t-1}+0.18{\tt GDPGR}_{t-2}-0.13{\tt TSpread}_{t-1}+0.62{\tt TSpread}_{t-2}. \end{align} \]

mydata = pd.merge(dfGrowth, dfTermSpread, left_index=True, right_index=True)

# Read the data

mydata = mydata.loc['1962-01-01':'2017-07-01', ['YGROWTH', 'RSPREAD']]

mydata = mydata.dropna()

# Create lagged variables for ADL(2,1) and ADL(2,2)

mydata['Ylag1'] = mydata['YGROWTH'].shift(1)

mydata['Ylag2'] = mydata['YGROWTH'].shift(2)

mydata['RSpread_lag1'] = mydata['RSPREAD'].shift(1)

mydata['RSpread_lag2'] = mydata['RSPREAD'].shift(2)

# ADL(2,1) Model

adl21_model = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1) + YGROWTH.shift(2) + RSPREAD.shift(1)', data=mydata).fit(cov_type='HC1')

# adl21_model = smf.ols(formula='YGROWTH ~ Ylag1 + Ylag2 + RSpread_lag1', data=mydata[2:]).fit(cov_type='HC1')

# ADL(2,2) Model

adl22_model = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1) + YGROWTH.shift(2) + RSPREAD.shift(1) + RSPREAD.shift(2)', data=mydata).fit(cov_type='HC1')

# adl22_model = smf.ols(formula='YGROWTH ~ Ylag1 + Ylag2 + RSpread_lag1 + RSpread_lag2', data=mydata[3:]).fit(cov_type='HC1')# Present the models using summary_col

info_dict={'N':lambda x: "{0:d}".format(int(x.nobs)),

'AIC':lambda x: "{:.2f}".format(x.aic),

'BIC':lambda x: "{:.2f}".format(x.bic),

}

results_table = summary_col([adl21_model, adl22_model], stars=True, model_names=['ADL(2,1)', 'ADL(2,2)'], info_dict=info_dict, float_format='%0.3f')

results_table| ADL(2,1) | ADL(2,2) | |

| Intercept | 0.946** | 0.949** |

| (0.474) | (0.462) | |

| YGROWTH.shift(1) | 0.265*** | 0.242*** |

| (0.081) | (0.077) | |

| YGROWTH.shift(2) | 0.189** | 0.175** |

| (0.077) | (0.076) | |

| RSPREAD.shift(1) | 0.421** | -0.132 |

| (0.182) | (0.420) | |

| RSPREAD.shift(2) | 0.621 | |

| (0.428) | ||

| R-squared | 0.165 | 0.175 |

| R-squared Adj. | 0.153 | 0.160 |

| AIC | 1114.66 | 1113.97 |

| BIC | 1128.25 | 1130.96 |

| N | 221 | 221 |

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

The estimated coefficients in the ADL(\(2,2\)) model on TSpread are statistically insignificant at the 5% level. The joint null hypothesis \(H_0:\delta_1=\delta_2=0\) can be tested using the F-statistic. The \(F\)-test result below shows that the coefficients on the term spread are jointly statistically significant.

hypotheses = ['RSPREAD.shift(1)=0', 'RSPREAD.shift(2)=0']

ftest = adl22_model.f_test(hypotheses)

print(ftest)<F test: F=3.9805978401042403, p=0.020060657423667954, df_denom=216, df_num=2>Finally, we use the ADL(\(2,2\)) model to forecast the GDP growth rate in 2017:Q4. The forecasted GDP growth rate is \[ \begin{align*} \widehat{\text{GDPGR}}_{2017:Q4|2017:Q3} &=0.95+0.24{\tt GDPGR}_{2017:Q3}+0.18{\tt GDPGR}_{2017:Q2}\\ &-0.13{\tt TSpread}_{2017:Q3}+0.62{\tt TSpread}_{2017:Q2} \\ &=0.95 + 0.24 \times 3.11 + 0.18 \times 3.01 - 0.13 \times 1.21 + 0.62 \times 1.37\\ &= 0.95 + 0.7464 + 0.5418 - 0.1573 + 0.8494 = 2.93. \end{align*} \] The actual GDP growth rate in 2017:Q4 was 2.5. Hence, the forecast error is \(2.5 - 2.93 = -0.43\) percentage points.

In the following code chunk, we estimate the ADL(\(2,1\)) and ADL(\(2,2\)) models for the GDP growth rate using the ARIMA() function from the statsmodels.tsa.arima.model module. Note that the parameter estimates are slightly different from those in Table 25.6, as the ARIMA() function uses a different estimation method.

mydata = pd.merge(dfGrowth, dfTermSpread, left_index=True, right_index=True)

# Read the data

mydata = mydata.loc['1962-01-01':'2017-07-01', ['YGROWTH', 'RSPREAD']]

mydata = mydata.dropna()

# Create lagged variables for ADL(2,1) and ADL(2,2)

mydata['Ylag1'] = mydata['YGROWTH'].shift(1)

mydata['Ylag2'] = mydata['YGROWTH'].shift(2)

mydata['RSpread_lag1'] = mydata['RSPREAD'].shift(1)

mydata['RSpread_lag2'] = mydata['RSPREAD'].shift(2)# ADL(2,1) Model

model_adl21 = ARIMA(mydata['YGROWTH'][2:], order=(2, 0, 0), exog=mydata[['RSpread_lag1']][2:])

adl21_model = model_adl21.fit()

print(adl21_model.summary()) SARIMAX Results

==============================================================================

Dep. Variable: YGROWTH No. Observations: 221

Model: ARIMA(2, 0, 0) Log Likelihood -554.521

Date: Wed, 26 Nov 2025 AIC 1119.041

Time: 08:51:17 BIC 1136.032

Sample: 07-01-1962 HQIC 1125.902

- 07-01-2017

Covariance Type: opg

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 2.1486 0.466 4.609 0.000 1.235 3.062

RSpread_lag1 0.5128 0.239 2.147 0.032 0.045 0.981

ar.L1 0.2602 0.061 4.282 0.000 0.141 0.379

ar.L2 0.1875 0.060 3.105 0.002 0.069 0.306

sigma2 8.8427 0.572 15.454 0.000 7.721 9.964

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 58.31

Prob(Q): 0.97 Prob(JB): 0.00

Heteroskedasticity (H): 0.38 Skew: 0.12

Prob(H) (two-sided): 0.00 Kurtosis: 5.51

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).# ADL(2,2) Model

model_adl22 = ARIMA(mydata['YGROWTH'][3:], order=(2, 0, 0), exog=mydata[['RSpread_lag1', 'RSpread_lag2']][3:])

adl22_model = model_adl22.fit()

print(adl22_model.summary()) SARIMAX Results

==============================================================================

Dep. Variable: YGROWTH No. Observations: 220

Model: ARIMA(2, 0, 0) Log Likelihood -549.573

Date: Wed, 26 Nov 2025 AIC 1111.145

Time: 08:51:17 BIC 1131.507

Sample: 10-01-1962 HQIC 1119.368

- 07-01-2017

Covariance Type: opg

================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------

const 1.7937 0.489 3.671 0.000 0.836 2.751

RSpread_lag1 -0.1440 0.361 -0.399 0.690 -0.852 0.564

RSpread_lag2 0.8788 0.348 2.528 0.011 0.198 1.560

ar.L1 0.2554 0.061 4.194 0.000 0.136 0.375

ar.L2 0.1808 0.061 2.951 0.003 0.061 0.301

sigma2 8.6494 0.561 15.407 0.000 7.549 9.750

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 62.78

Prob(Q): 0.95 Prob(JB): 0.00

Heteroskedasticity (H): 0.39 Skew: 0.25

Prob(H) (two-sided): 0.00 Kurtosis: 5.57

===================================================================================

Warnings:

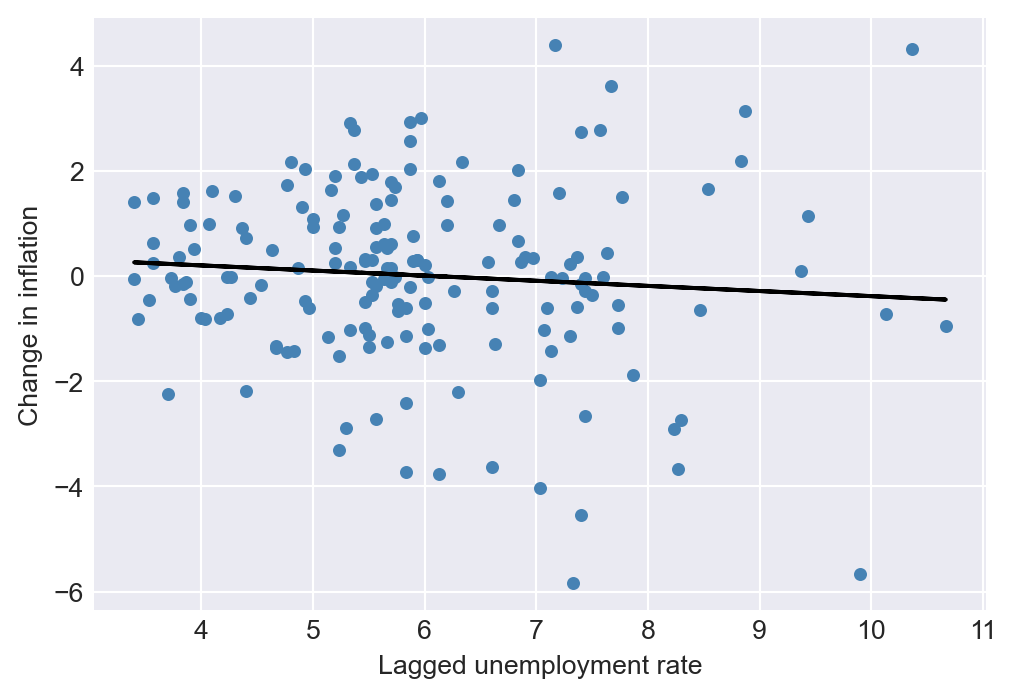

[1] Covariance matrix calculated using the outer product of gradients (complex-step).As an another example, we consider the inflation rate in the macroseries.csv file. According to the well-known Phillips curve, if unemployment is above its natural rate, then the rate of inflation is predicted to decrease. Hence, the change in inflation is negatively related to the lagged unemployment rate. Accordingly, Figure 25.10 shows that there is a negative relationship between the change in inflation and the lagged unemployment rate.

# The relationship between the change in inflation and the lagged unemployment rate

# Create lagged variables for the unemployment rate

df['L1_u_rate'] = df['u_rate'].shift(1)

df['L2_u_rate'] = df['u_rate'].shift(2)

df['L3_u_rate'] = df['u_rate'].shift(3)

df['L4_u_rate'] = df['u_rate'].shift(4)

# Subset the data

df_subset = df.loc['1962-01-01':'2004-10-01',:]

phillips = smf.ols(formula = 'Delta_Inf ~ L1_u_rate', data = df_subset).fit()

# Generate predictions for the fitted line

df_subset['predictions'] = phillips.predict(df_subset)

fig, ax = plt.subplots(figsize = (6,4))

ax.scatter('L1_u_rate', 'Delta_Inf', data = df_subset, color = 'steelblue', alpha = 1, label = 'Data', s = 15)

ax.plot(df_subset['L1_u_rate'], df_subset['predictions'], linestyle = '-', color = 'black', label = 'Fitted line', linewidth = 1.5)

ax.set(xlabel = 'Lagged unemployment rate', ylabel = 'Change in inflation')

plt.show()

We consider the following ARDL(4,4) model for the change in inflation rate: \[ \begin{align*} \Delta \text{Inf}_t &= \beta_0 + \beta_1\Delta \text{Inf}_{t-1} + \beta_2\Delta \text{Inf}_{t-2} + \beta_3\Delta \text{Inf}_{t-3} + \beta_4\Delta \text{Inf}_{t-4}\\ &\quad + \delta_1\text{Urate}_{t-1} + \delta_2\text{Urate}_{t-2} + \delta_3\text{Urate}_{t-3} + \delta_4\text{Urate}_{t-4} + u_t, \end{align*} \tag{25.12}\] where \(\text{Urate}_t\) is the unemployment rate at time \(t\). The ARDL(4,4) model includes four lags of the change in inflation and four lags of the unemployment rate as predictors. The estimation results are presented in Table 25.7.

adl44 = smf.ols(formula = 'Delta_Inf ~ L1_Delta_Inf + L2_Delta_Inf + L3_Delta_Inf + L4_Delta_Inf + L1_u_rate + L2_u_rate + L3_u_rate + L4_u_rate',

data = df_subset).fit(cov_type='HC1')# Present the models using summary_col

info_dict={'N':lambda x: "{0:d}".format(int(x.nobs)),

'AIC':lambda x: "{:.2f}".format(x.aic),

'BIC':lambda x: "{:.2f}".format(x.bic),

}

results_table = summary_col([adl44], stars=True, model_names=['ADL(4,4)'], info_dict=info_dict, float_format='%0.3f')

results_table| ADL(4,4) | |

| Intercept | 1.304*** |

| (0.452) | |

| L1_Delta_Inf | -0.420*** |

| (0.089) | |

| L2_Delta_Inf | -0.367*** |

| (0.094) | |

| L3_Delta_Inf | 0.057 |

| (0.085) | |

| L4_Delta_Inf | -0.036 |

| (0.084) | |

| L1_u_rate | -2.636*** |

| (0.475) | |

| L2_u_rate | 3.043*** |

| (0.880) | |

| L3_u_rate | -0.377 |

| (0.912) | |

| L4_u_rate | -0.248 |

| (0.461) | |

| R-squared | 0.366 |

| R-squared Adj. | 0.335 |

| N | 172 |

| AIC | 610.79 |

| BIC | 639.12 |

Standard errors in parentheses.

* p<.1, ** p<.05, ***p<.01

We observe that the fit improves significantly compared to the AR(\(4\)) model in Table 25.5, as the reported adjusted R-squared is 0.335. Furthermore, the F-statistic for the joint null hypothesis \(H_0:\delta_1=\ldots=\delta_4=0\) indicates that the additional time lag terms for the unemployment rate are jointly statistically significant at the 5% level.

hypotheses = ['L1_u_rate=0', 'L2_u_rate=0', 'L3_u_rate=0', 'L4_u_rate=0']

ftest = adl44.f_test(hypotheses)

print('The F test value is {0:.3f} with a p-value of {1:.4f}.'.format(ftest.statistic, ftest.pvalue))The F test value is 8.443 with a p-value of 0.0000.25.8 The least squares assumptions for forecasting with multiple predictors

In this section, we state the assumptions that we need for the estimation of the AR and ADL models by the OLS estimator. We consider the following general ADL model, which includes \(m\) additional predictors. In this model, \(q_1\) lags of the first predictor, \(q_2\) lags of the second predictor, and so forth are incorporated: \[ \begin{align*} Y_t &= \beta_0 + \beta_1Y_{t-1} + \beta_2Y_{t-2} +\dots+ \beta_pY_{t-p}\\ &\quad +\delta_{11}X_{1,t-1} + \delta_{12}X_{1,t-2} + \dots +\delta_{1q_1}X_{1,t-q_1} + \dots \\ &\quad + \delta_{m1}X_{m,t-1} + \delta_{m2}X_{m,t-2} + \dots +\delta_{mq_m}X_{m,t-q_m}+u_t. \end{align*} \tag{25.13}\]

The first assumption indicates that the error term \(u_t\) has zero conditional mean given the lagged values of the dependent variable and the predictors. This assumption has two implications: (i) the error terms \(u_t\)’s are serially uncorrelated, and (ii) the lag lengths \(p\), \(q_1\), \(q_2\), , \(q_m\) are correctly specified, such that the coefficients of lag terms beyond \(p\), \(q_1\), \(q_2\), , \(q_m\) are zero. The first part of the second assumption indicates that the distribution of data does not change over time. This part can be considered as the time series version of the i.i.d asumption we used for the cross-sectional data. The second part indicates that \(\left(Y_t, X_{1t},\dots, X_{mt}\right)\) and \(\left(Y_{t-k}, X_{1,t-k},\dots,X_{m,t-k}\right)\) become independent as \(k\) gets larger. This assumption is sometimes referred to as the weak dependence assumption. The third and fourth assumptions are same as the ones we used for the multiple linear regression model.

Theorem 25.1 (Properties of OLS estimator using time series data) Under the least squares assumptions, the large-sample properties of the OLS estimator are similar to those in the case of cross-sectional data. Namely, the OLS estimator is consistent and has an asymptotic normal distribution when \(T\) is large.

25.9 Lag order selection

How should we choose the number of lags \(p\) in an AR(\(p\)) model? One approach to determining the number of lags is to use sequential downward \(t\) or \(F\) tests. However, this method may select a large number of lags. Alternatively, we can use information criteria to select the lag order. Information criteria balance bias (too few lags) against variance (too many lags).

Two widely used information criteria are the Bayesian information criterion (BIC) and the Akaike information criterion (AIC). For an AR(\(p\)) model, the BIC and AIC are defined as \[ \begin{align*} \text{BIC}(p) &= \ln\frac{SSR(p)}{T} + (p+1)\frac{\ln T}{T}, \\ \text{AIC}(p) &= \ln\frac{SSR(p)}{T} + (p+1)\frac{2}{T}, \end{align*} \tag{25.14}\] where \(SSR(p)\) is the sum of squared residuals from the AR(\(p\)) model. The estimator of \(p\) is the value that minimizes the BIC or AIC. That is, if \(\hat{p}\) is the estimator of \(p\), then it is defined as \[ \hat{p} = \arg\min_{p} \text{BIC}(p) \quad \text{or} \quad \hat{p} = \arg\min_{p} \text{AIC}(p). \tag{25.15}\]

Note that the first term in both BIC and AIC is always decreasing in \(p\) (larger \(p\), better fit). The second term is always increasing in \(p\). The second term is a penalty for using more parameters, and thus increasing the forecast variance. The penalty term is smaller for AIC than BIC, hence AIC estimates more lags (larger \(p\)) than the BIC. This may be desirable if we believe that longer lags are important for the dynamics of the process.

Theorem 25.2 The BIC estimator of \(p\) is a consistent estimator in the sense that \(P(\hat{p}=p)\to 1\), whereas the AIC estimator is not consistent.

Proof (Proof of Theorem 25.2). For simplicity, assume that true \(p\) is \(1\), then we need to show that (i) \(P(\hat{p}=0)\to 0\) and (ii) \(P(\hat{p}=2)\to 0\). To choose \(\hat{p}=0\), it must be the case that \(\text{BIC}(0)-\text{BIC}(1)<0\). Consider \(\text{BIC}(0)-\text{BIC}(1)\): \[ \text{BIC}(0)-\text{BIC}(1)=\ln(SSR(0)/T)-\ln(SSR(1)/T) -\ln(T)/T. \] It follows that \(SSR(0)/T=((T-1)/T)s_Y^2\to\sigma^2_Y\), where \(\sigma^2_Y\) is the variance of the process \(Y\) and \(s_Y^2\) is its sample counterpart. Similarly, \(SSR(1)/T=((T-2)/T)s^2_{\hat{u}}\to\sigma^2_{u}\), where \(\sigma^2_u\) is the variance of the error term. Thus, \[ \text{BIC}(0)-\text{BIC}(1)\to\ln(\sigma^2_Y)-\ln(\sigma^2_u), \] because \(\ln(T)/T\to 0\). Since \(\sigma^2_Y>\sigma^2_u\), it follows that \(\text{BIC}(0)-\text{BIC}(1)>0\). This implies that \(P(\hat{p}=0)\to 0\).

Simlarly, to choose \(\hat{p}=2\), it must be the case that \(\text{BIC}(2)-\text{BIC}(1)<0\). Consider \(T[\text{BIC}(2)-\text{BIC}(1)]\): \[ \begin{align*} &T[\text{BIC}(2)-\text{BIC}(1)]= T[\ln(SSR(2)/T)-\ln(SSR(1)/T)] +\ln(T)\\ &=T\ln(SSR(2)/SSR(1))+\ln(T)=-T\ln(1+F/(T-2))+\ln(T), \end{align*} \] where \(F=(SSR(1)-SSR(2))/(SSR(2)/(T-2))\) is the homoskedasticity-only \(F\)-statistic for testing \(H_0:\beta_2=0\) in the AR(\(2\)) model. Then, \[ \begin{align*} P(\text{BIC}(2)-\text{BIC}(1)<0)&= P(T[\text{BIC}(2)-\text{BIC}(1)]<0)\\ &=P([-T\ln(1+F/(T-2))+\ln(T)]<0)\\ \end{align*} \] Since \(T\ln(1+F/(T-2))-F\approx TF/(T-2)-F\xrightarrow{p}0\), we have \[ \begin{align*} P(\text{BIC}(2)-\text{BIC}(1)<0)&=P(T\ln(1+F/(T-2))>\ln(T))\to P(F>\ln(T))\to 0. \end{align*} \] Thus, \(P(\hat{p}=2)\to0\).

For the general case where \(0\leq p\leq p_{max}\), we can use the same argument to show that \(P(\hat{p}<p)\to0\) and \(P(\hat{p}>p)\to0\). Therefore, the BIC estimator is consistent.

In the case of AIC, we can use the same argument to show that \(P(\hat{p}=0)\to 0\). However, to show that \(P(\hat{p}=2)\to 0\), we need to show that \(P(\text{AIC}(2)-\text{AIC}(1)<0)\to 0\). Using the same argument as above, we have \[ \begin{align*} P(\text{AIC}(2)-\text{AIC}(1)<0)&=P(F>2)>0. \end{align*} \] Therefore, the AIC estimator is not consistent. For example, if the error terms are homoskedastic, then \[ \begin{align*} P(\text{AIC}(2)-\text{AIC}(1)<0)&=P(F>2)\to P(\chi^2_1>2)=0.16. \end{align*} \] In general, we have \(P(\hat{p}<p)\to0\), but \(P(\hat{p}>p)\not\to0\). Thus, the AIC can overestimate the number of lags even in large samples.

In Python, we can use statsmodels.api.tsa.arma_order_select_ic() to calculate AIC and BIC and the corresponding lag orders. As an example, consider determining the lag order of an AR model for the GDP growth rate. The lag order selected by the AIC is 4, while the BIC selects 2.

mydata = dfGrowth.loc['1962-01-01':'2017-07-01', ['YGROWTH']]

lag_order = sm.tsa.arma_order_select_ic(mydata.YGROWTH,

max_ar = 8, max_ma = 0,

ic = ['aic', 'bic'],

trend = 'n')

print('The lag order selected by AIC is {0:1.0f} and by BIC is {1:1.0f}.'.format(lag_order.aic_min_order[0], lag_order.bic_min_order[0]))The lag order selected by AIC is 4 and by BIC is 2.As another example, we consider the inflation rate in the macroseries.csv file. According to the results given below, the AIC suggests an AR(\(3\)) model, while the BIC suggests an AR(\(2\)) model for the change in inflation rate.

lag_order = sm.tsa.arma_order_select_ic(df_subset.Delta_Inf,

max_ar = 8, max_ma = 0,

ic = ['aic', 'bic'],

trend = 'n')

print('The lag order selected by AIC is {0:1.0f} and by BIC is {1:1.0f}.'.format(lag_order.aic_min_order[0], lag_order.bic_min_order[0]))The lag order selected by AIC is 3 and by BIC is 2.As in an autoregression, the BIC and the AIC can also be used to estimate the number of lags and variables in the time series regression model with multiple predictors. If the regression model has \(k\) coefficients (including the intercept), then \[ \begin{align} &\text{BIC}(k)=\ln\left(SSR(k)/T\right)+k\ln(T)/T,\\ &\text{AIC}(k)=\ln\left(SSR(k)/T\right)+2k/T. \end{align} \]

For each value of \(k\), the BIC (or AIC) can be computed, and the model with the lowest value of the BIC (or AIC) is preferred based on the information criterion.

25.10 Estimation of the MSFE and forecast intervals

Stock and Watson (2020) consider three estimators for estimating the MSFE. These estimators are:

- The standard error of the regression (SER) estimator,

- The final prediction error (FPE) estimator, and

- The pseudo out-of-sample (POOS) forecasting estimator.

The first two estimators are derived from the expression for the MSFE and rely on the stationarity assumption. Under stationarity, the MSFE for an AR(\(p\)) model can be expressed as: \[ \begin{align*} \text{MSFE}&=\E\left[\left(Y_{T+1}-\widehat{Y}_{T+1|T}\right)^2\right]\\ &=\E\big[(\beta_0+\beta_1 Y_{T}+\beta_2Y_{T-1}+\ldots+\beta_pY_{T-p+1}+u_{T+1}\\ &\quad- (\hat{\beta}_0+\hat{\beta}_1 Y_{T}+\hat{\beta}_2Y_{T-1}+\ldots+\hat{\beta}_pY_{T-p+1}))^2\big]\\ &=\E(u^2_{T+1})+\E\left(\left((\hat{\beta}_0-\beta_0)+(\hat{\beta}_1-\beta_1)Y_T+\ldots+(\beta_p-\hat{\beta}_p)Y_{T-p+1}\right)^2\right). \end{align*} \tag{25.16}\]

Since the variance of the OLS estimator is proportional to \(1/T\), the second term is is proportional to \(1/T\). Consequently, if the number of observations \(T\) is large relative to the number of autoregressive lags \(p\), then the contribution of the second term is small relative to the first term. This leads to the approximation MSFE\(\approx\sigma^2_u\), where \(\sigma^2_u\) is the variance of \(u_t\). Based on this simplification, the SER estimator of the MSFE is formulated as \[ \begin{align} \widehat{MSFE}_{SER}=s^2_{\hat{u}},\quad\text{where}\quad s^2_{\hat{u}}=\frac{SSR}{T-p-1}, \end{align} \tag{25.17}\] where \(SSR\) is the sum of squared residuals from the autoregression. Note that this method assumes stationarity and ignores estimation error stemming from the estimation of the forecast rule.

The FPE method incorporates both terms in the MSFE formula under the additional assumption that the error are homoskedastic. Under homoskedasticity, it can be shown that (see Appendix B) \[ \E\left(\left((\hat{\beta}_0-\beta_0)+(\hat{\beta}_1-\beta_1)Y_T+\ldots+(\beta_p-\hat{\beta}_p)Y_{T-p+1}\right)^2\right)\approx \sigma^2_u((p+1)/T). \] Then, the MSFE can be expressed as \(\text{MSFE}=\sigma^2_u+\sigma^2_u((p+1)/T)=\sigma^2_u(T+p+1)/T\). Then, the FPE estimator is given by \[ \begin{align} \widehat{MSFE}_{FPE}=\left(\frac{T+p+1}{T}\right)s^2_{\hat{u}}=\left(\frac{T+p+1}{T-p-1}\right)\frac{SSR}{T}. \end{align} \tag{25.18}\]

The third method, the pseudo out-of-sample (POOS) forecasting, does not require the stationarity assumption. In the following callout, we show how the POOS method is implemented.

Once we have an estimate of the MSFE, we can construct a forecast interval for \(Y_{T+1}\). Assuming that \(u_{T+1}\) is normally distributed, the 95% forecast interval is given by \[ \widehat{Y}_{T|T-1}\pm 1.96\times \widehat{\text{RMSFE}}. \]

The 95% forecast interval is not a confidence interval for \(Y_{T+1}\). The key distinction is that \(Y_{T+1}\) is a random variable, not a fixed parameter. Nevertheless, the forecast interval is widely used in practice as a measure of forecast uncertainty and can still provide a reasonable approximation, even when \(u_{T+1}\) is not normally distributed.

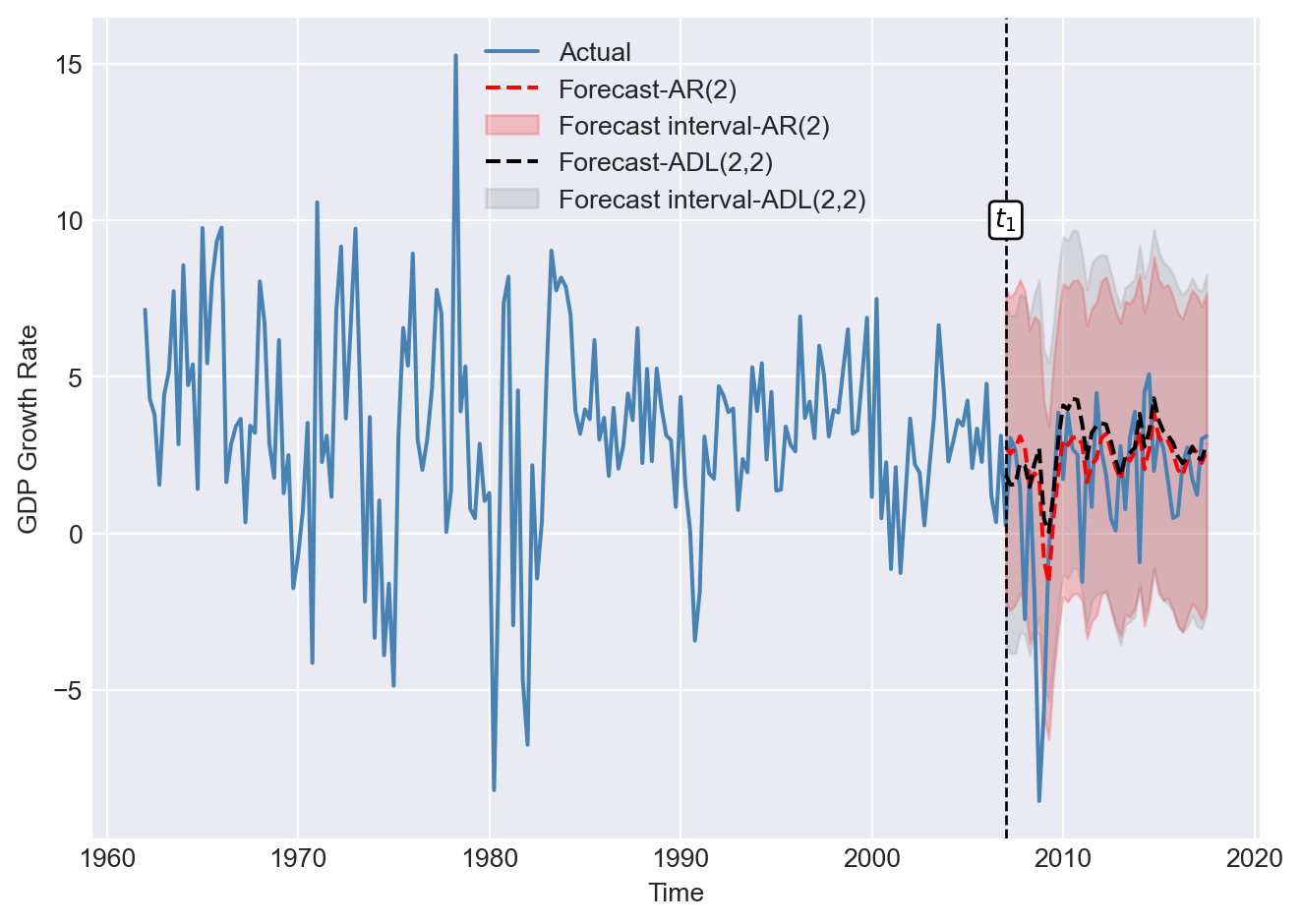

As an example, we compare the forecasting performance of the AR(\(2\)) model in Equation 25.8 with that of the ADL(\(2,2\)) model in Equation 25.11. In the following code chunk, we estimate both models and compute the SER and FPE estimates of the RMSFE. Using the POOS method, we forecast the GDP growth rate over the period 2007:Q1 to 2017:Q3 with both models.

# RMSFE estimates for AR(2) and ADL(2,2) models

mydata = pd.merge(dfGrowth, dfTermSpread, left_index=True, right_index=True)

mydata = mydata.loc['1962-01-01':'2017-07-01', ['YGROWTH', 'RSPREAD']]

mydata = mydata.dropna()

# AR(2) Model

ar_result = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1) + YGROWTH.shift(2)', data=mydata).fit(vcov_type='HC1')

# ADL(2,2) model

adl_result = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1) + YGROWTH.shift(2) + RSPREAD.shift(1) + RSPREAD.shift(2)', data=mydata).fit(cov_type='HC1')

# Compute the RMSFE using the SER and FPE methods

RMSFE_SER_AR = np.sqrt(ar_result.mse_resid)

RMSFE_FPE_AR = np.sqrt(((ar_result.nobs+2+1)/ar_result.nobs)*ar_result.mse_resid)

RMSFE_SER_ADL = np.sqrt(adl_result.mse_resid)

RMSFE_FPE_ADL = np.sqrt(((adl_result.nobs+4+1)/adl_result.nobs)*adl_result.mse_resid)

# Index positions for the start and end dates

t1 = np.where(mydata.index == "2007-01-01")[0][0]

T = np.where(mydata.index == "2017-07-01")[0][0]

# Preallocate array for savers

savers_ar2 = np.empty((T-t1+1, 2))

savers_adl = np.empty((T-t1+1, 2))

# Loop over each time step

for t in range(T - t1 + 1):

end_date0 = mydata.index[t1 + t]

end_date1 = mydata.index[t1 + t - 1]

end_date2 = mydata.index[t1 + t - 2]

# Prepare the data for the regression model

data_slice = mydata.loc["1962-01-01":end_date1, :]

# Fit AR(2) model

ar_model = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1) + YGROWTH.shift(2)', data=data_slice).fit(vcov_type='HC1')

# Get model parameters

params1 = ar_model.params

# Get one step ahead forecast for AR(2)

forecast_ar = (params1[0] + params1[1] * mydata.loc[end_date1, "YGROWTH"] +

params1[2] * mydata.loc[end_date2, "YGROWTH"] )

# Save forecast errors and forecast

savers_ar2[t,0] = mydata.loc[end_date0, "YGROWTH"] - forecast_ar

savers_ar2[t,1] = forecast_ar

# Fit ADL(2,2) model

adl_model = smf.ols(formula='YGROWTH ~ YGROWTH.shift(1) + YGROWTH.shift(2) + RSPREAD.shift(1) + RSPREAD.shift(2)', data=data_slice).fit(cov_type='HC1')

# Get model parameters

params2 = adl_model.params

# Get one step ahead forecast for ADL(2,2)

forecast_adl = (params2[0] + params2[1] * mydata.loc[end_date1, "YGROWTH"] +

params2[2] * mydata.loc[end_date2, "YGROWTH"]+

params2[3] * mydata.loc[end_date1, "RSPREAD"] +

params2[4] * mydata.loc[end_date2, "RSPREAD"])

# Save forecast errors and forecast

savers_adl[t,0] = mydata.loc[end_date0, "YGROWTH"] - forecast_adl

savers_adl[t,1] = forecast_adl

# Compute RMSFE for the POOS method

RMSFE_POOS_AR = np.sqrt(np.mean(savers_ar2[:,0] ** 2))

RMSFE_POOS_ADL = np.sqrt(np.mean(savers_adl[:,0] ** 2))The estimated RMSFE values are presented in Table 25.8. The results show that, for both models, the FPE estimate is slightly larger than the SER estimate, consistent with the formulas in Equation 25.17 and Equation 25.18. The POOS method yields the smallest RMSFE estimates for both models. Since the POOS estimate is slightly lower for the AR(\(2\)) model, we conclude that the AR(\(2\)) model is preferred over the ADL(\(2,2\)) model for forecasting the GDP growth rate.

# Create DataFrame

pd.DataFrame({

'RMSFE_POOS': [RMSFE_POOS_AR, RMSFE_POOS_ADL],

'RMSFE_SER': [RMSFE_SER_AR, RMSFE_SER_ADL],

'RMSFE_FPE': [RMSFE_FPE_AR, RMSFE_FPE_ADL]

}, index=['AR(2)', 'ADL(2,2)']).round(3)| RMSFE_POOS | RMSFE_SER | RMSFE_FPE | |

|---|---|---|---|

| AR(2) | 2.551 | 3.023 | 3.043 |

| ADL(2,2) | 2.749 | 2.975 | 3.008 |

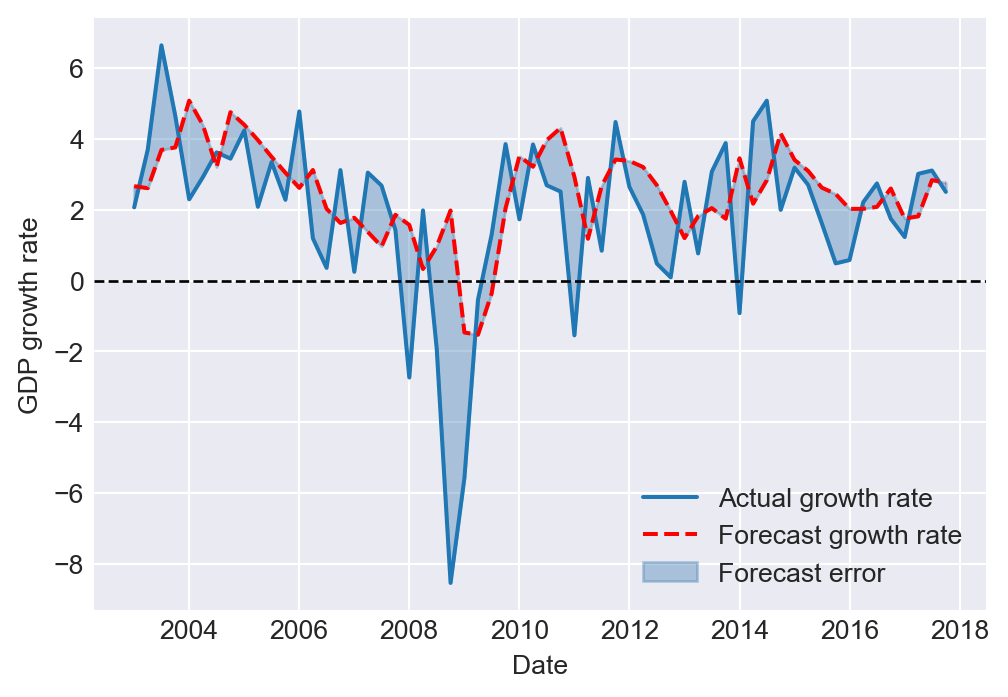

In Figure 25.11, we plot the one-step-ahead forecasted values obtained using the POOS method from both models. We also include the 95% forecast intervals. Note that the forecast intervals include the true values, except during the Great Ression of 2007.

# Index positions for the start and end dates

t1 = np.where(mydata.index == "2007-01-01")[0][0]

T = np.where(mydata.index == "2017-07-01")[0][0]

# Create DataFrames to store the forecasts

forecasts_ar = pd.DataFrame({'forecasts': np.nan}, index=mydata.index)

forecasts_adl = pd.DataFrame({'forecasts': np.nan}, index=mydata.index)

# Fill in the forecasts in the DataFrame

forecasts_ar.loc['2007-01-01':'2017-07-01', 'forecasts'] = savers_ar2[:, 1]

forecasts_adl.loc['2007-01-01':'2017-07-01', 'forecasts'] = savers_adl[:, 1]

# Compute the forecast intervals

forecast_interval_ar = 1.96 * RMSFE_POOS_AR

forecast_interval_adl = 1.96 * RMSFE_POOS_ADL

# Create a figure and axis

fig, ax = plt.subplots(figsize=(7, 5))

# Plot the actual GDP growth rate

ax.plot(mydata.index, mydata['YGROWTH'], linestyle='-', label='Actual', color='steelblue', linewidth=1.5)

# Plot the forecasted GDP growth rate from AR(2)

ax.plot(forecasts_ar.index, forecasts_ar['forecasts'], color='red', linestyle='--', label='Forecast-AR(2)', linewidth=1.5)

ax.fill_between(forecasts_ar.index, forecasts_ar['forecasts'] - forecast_interval_ar, forecasts_ar['forecasts'] + forecast_interval_ar,

color='red', alpha=0.2, label='Forecast interval-AR(2)')

# Plot the forecasted GDP growth rate from ADL(2,2)

ax.plot(forecasts_adl.index, forecasts_adl['forecasts'], color='black', linestyle='--', label='Forecast-ADL(2,2)', linewidth=1.5)

ax.fill_between(forecasts_adl.index, forecasts_adl['forecasts'] - forecast_interval_adl, forecasts_adl['forecasts'] + forecast_interval_adl,

color='gray', alpha=0.2, label='Forecast interval-ADL(2,2)')

# Add a vertical line at the start date

ax.axvline(mydata.index[t1], color='black', linestyle='--', linewidth=1)

ax.text(mydata.index[t1], 10, r"$t_1$", color="black", fontsize=10,

horizontalalignment="center", verticalalignment="center",

bbox=dict(boxstyle="round", fc="white", ec="black", pad=0.2))

# Set the x and y labels

ax.set_xlabel('Time', fontsize=10)

ax.set_ylabel('GDP Growth Rate', fontsize=10)

# Add a legend

ax.legend(frameon=False, fontsize=10)

# Improve layout and show the plot

plt.tight_layout()

plt.show()

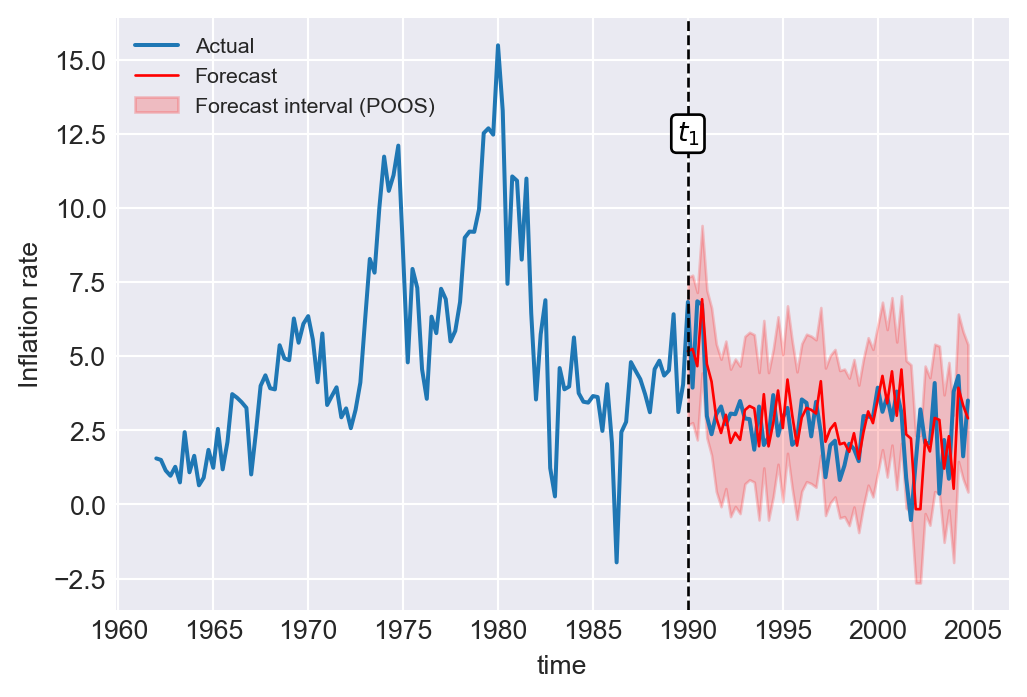

In the next example, we consider the ADL(\(4,4\)) model in Equation 25.12 for the change in inflation. We set \(t_1\) to 1990:Q1 and \(T\) to 2004:Q4. The estimated values of the RMSFE using the SER, FPE, and POOS methods are presented in Table 25.9. The results show that the FPE estimate is slightly larger than the SER estimate, which is consistent with the formulas given in Equation 25.17 and Equation 25.18. The POOS method provides the smallest estimate of the RMSFE.

# RMSFE estimates for the change in inflation

# Compute the RMSFE using the SER and FPE methods

RMSFE_SER = np.sqrt(adl44.mse_resid)

RMSFE_FPE = np.sqrt(((adl44.nobs+8+1)/adl44.nobs)*adl44.mse_resid)

# Index positions for the start and end dates

t1 = np.where(df_subset.index == "1990-01-01")[0][0]

T = np.where(df_subset.index == "2004-10-01")[0][0]

# Preallocate array for savers

savers_adl44 = np.empty((T-t1+1, 2))

# Loop over each time step

for t in range(T - t1 + 1):

end_date0 = df_subset.index[t1 + t]

end_date1 = df_subset.index[t1 + t - 1]

end_date2 = df_subset.index[t1 + t - 2]

end_date3 = df_subset.index[t1 + t - 3]

end_date4 = df_subset.index[t1 + t - 4]

# Prepare the data for the regression model

data_slice = df_subset.loc["1962-01-01":end_date1, :]

# Fit the OLS model

model = smf.ols(formula="Delta_Inf ~ L1_Delta_Inf + L2_Delta_Inf + L3_Delta_Inf + L4_Delta_Inf + L1_u_rate + L2_u_rate + L3_u_rate + L4_u_rate", data=data_slice).fit()

# Get model parameters

params = model.params

# Predict the value

predicted = (params[0] + params[1] * df_subset.loc[end_date1, "Delta_Inf"] +

params[2] * df_subset.loc[end_date2, "Delta_Inf"] +

params[3] * df_subset.loc[end_date3, "Delta_Inf"] +

params[4] * df_subset.loc[end_date4, "Delta_Inf"] +

params[5] * df_subset.loc[end_date1, "L1_u_rate"] +

params[6] * df_subset.loc[end_date2, "L1_u_rate"] +

params[7] * df_subset.loc[end_date3, "L1_u_rate"] +

params[8] * df_subset.loc[end_date4, "L1_u_rate"])

# Calculate the residual (savers)

savers_adl44[t,0] = df_subset.loc[end_date0, "Delta_Inf"] - predicted

savers_adl44[t,1] = df_subset.loc[end_date1, "Inf"] + predicted

# Compute RMSFE for the POOS method

RMSFE_POOS = np.sqrt(np.mean(savers_adl44[:,0] ** 2))# Create DataFrame

pd.DataFrame({

'RMSFE_POOS': [RMSFE_POOS],

'RMSFE_SER': [RMSFE_SER],

'RMSFE_FPE': [RMSFE_FPE]

}).round(3)| RMSFE_POOS | RMSFE_SER | RMSFE_FPE | |

|---|---|---|---|

| 0 | 1.268 | 1.393 | 1.429 |

Finally, we plot the one-step-ahead forecasted values obtained using the POOS method for the ADL(\(4,4\)) model of the change in the inflation rate. In Figure 25.12, we provide the plots of forecasts and the \(95\%\) forecast interval.

# Actual inflation rate and forecasts

# Index positions for the start and end dates

t1 = np.where(df_subset.index == "1990-01-01")[0][0]

T = np.where(df_subset.index == "2004-10-01")[0][0]

# Create a DataFrame to store the forecasts

forecasts = pd.DataFrame({'forecasts': np.nan}, index=pd.date_range(start='1962-01-01', end='2004-10-01', freq='QS'))

# Fill in the forecasts in the DataFrame

forecasts.loc['1990-01-01':'2004-10-01', 'forecasts'] = savers_adl44[:, 1]

# Compute the forecast interval

forecast_interval_POOS = 1.96 * RMSFE_POOS

forecast_interval_SER = 1.96 * RMSFE_SER

forecast_interval_FPE = 1.96 * RMSFE_FPE

# Create a figure and axis

fig, ax = plt.subplots(figsize=(6, 4))

# Plot the actual inflation rate

ax.plot('Inf', data=df_subset, linestyle='-', label='Actual')

# Plot the forecasted inflation rate

ax.plot('forecasts', data=forecasts, color='red', linestyle='-', label='Forecast', linewidth=1)

# Plot the upper and lower bounds of the forecast interval based on POOS

ax.fill_between(forecasts.index, forecasts['forecasts'] - forecast_interval_POOS, forecasts['forecasts'] + forecast_interval_POOS, color='red', alpha=0.2, label='Forecast interval (POOS)')

# Plot the upper and lower bounds of the forecast interval based on SER

# ax.fill_between(forecasts.index, forecasts['forecasts'] - forecast_interval_SER, forecasts['forecasts'] + forecast_interval_SER, color='none', alpha=0.2, label='Forecast interval (SER)')

# Plot the upper and lower bounds of the forecast interval based on FPE

# ax.fill_between(forecasts.index, forecasts['forecasts'] - forecast_interval_FPE, forecasts['forecasts'] + forecast_interval_FPE, color='none', alpha=0.2, label='Forecast interval (FPE)')

# Add a vertical line at the start date

ax.axvline(df_subset.index[t1], color='black', linestyle='--', linewidth=1)

# Add a text label for the start date

ax.text(df_subset.index[t1], 12.5, r"$t_1$",

color="black", fontsize=10,

horizontalalignment="center", verticalalignment="center",

bbox=dict(boxstyle="round", fc="white", ec="black", pad=0.2))

# Set the x and y labels

ax.set(xlabel='time', ylabel='Inflation rate')

# Add a legend

ax.legend(frameon = False, fontsize=8)

# Show the plot

plt.show()

25.11 Nonstationarity

The second assumption given in Section 22.8 requires that the random variables \((Y_t, X_{1t}, \dots, X_{mt})\) are stationary. If this assumption fails, forecasts, hypothesis tests, and confidence intervals become unreliable.

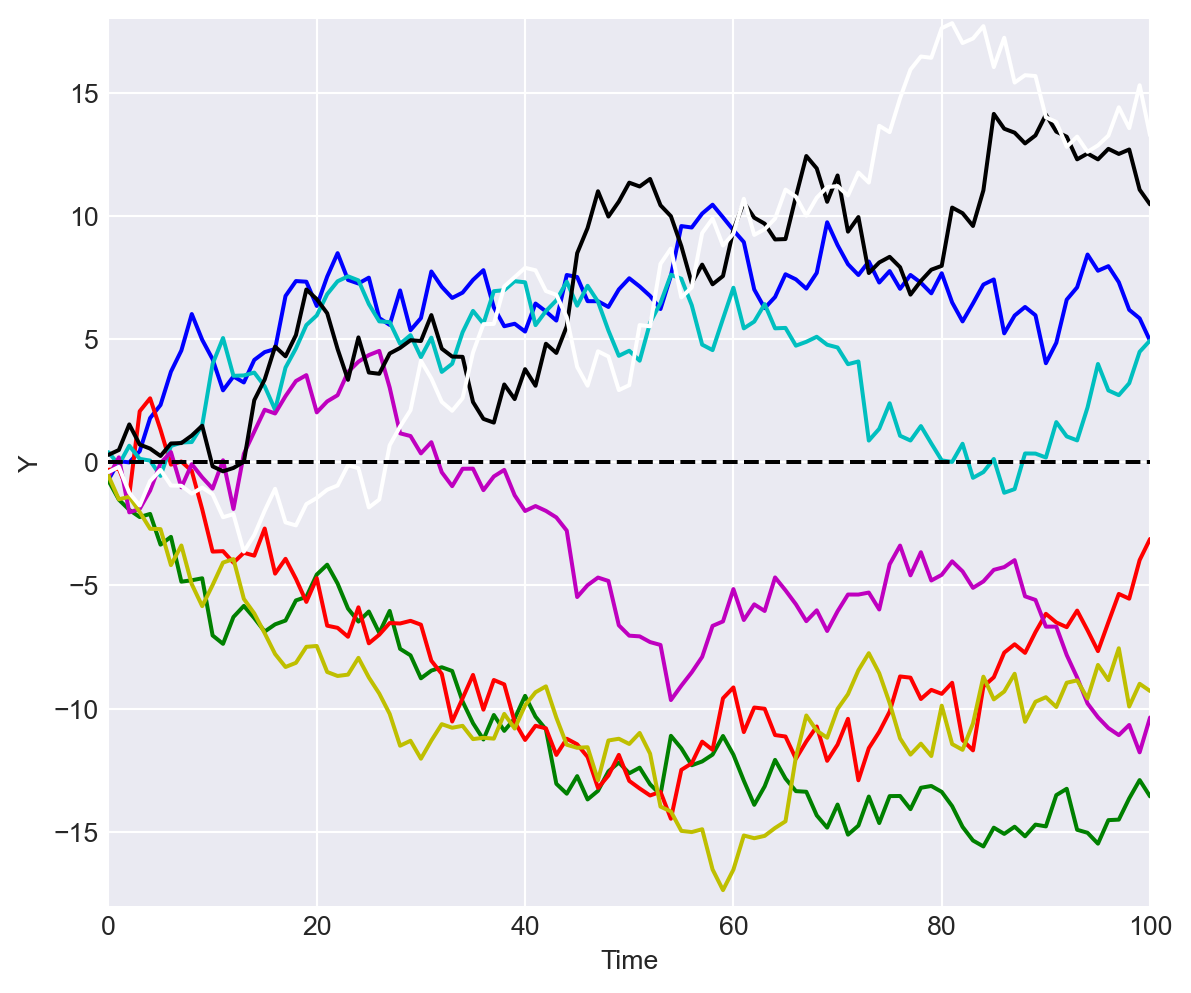

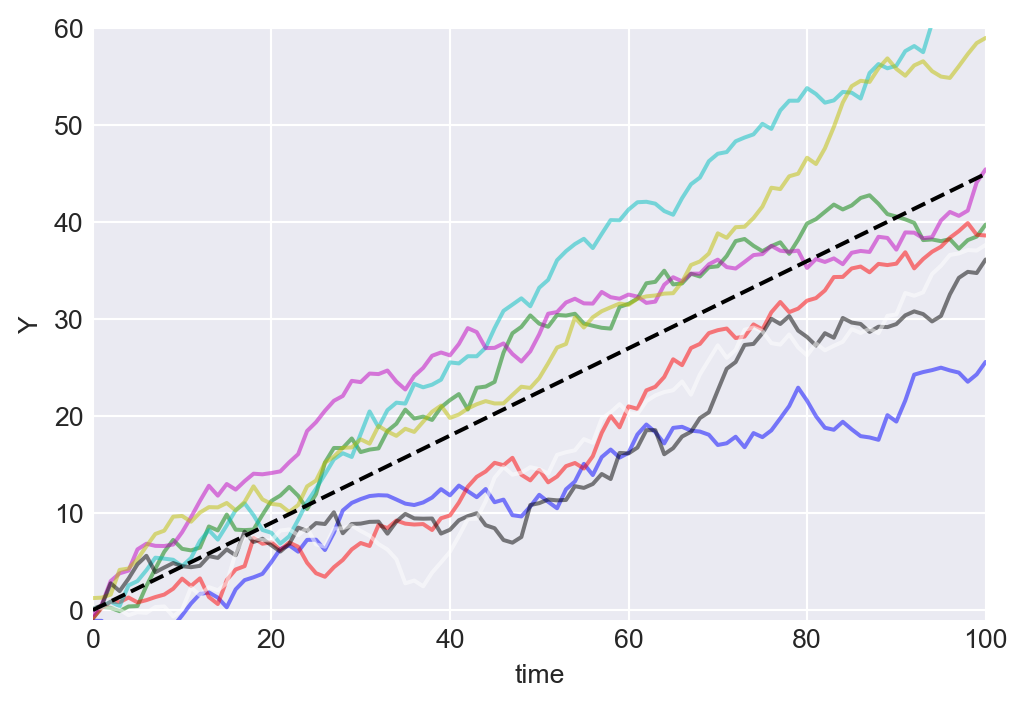

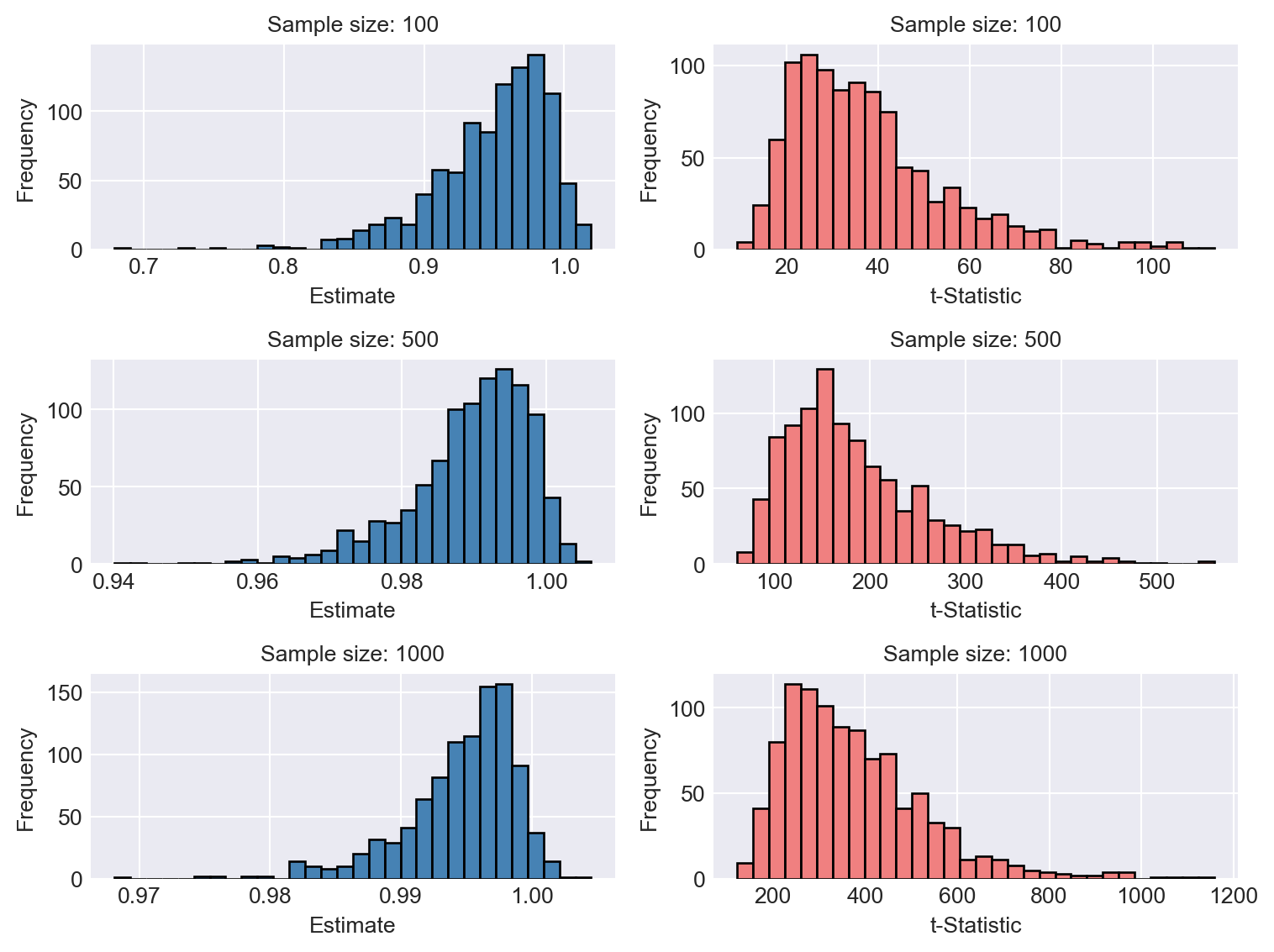

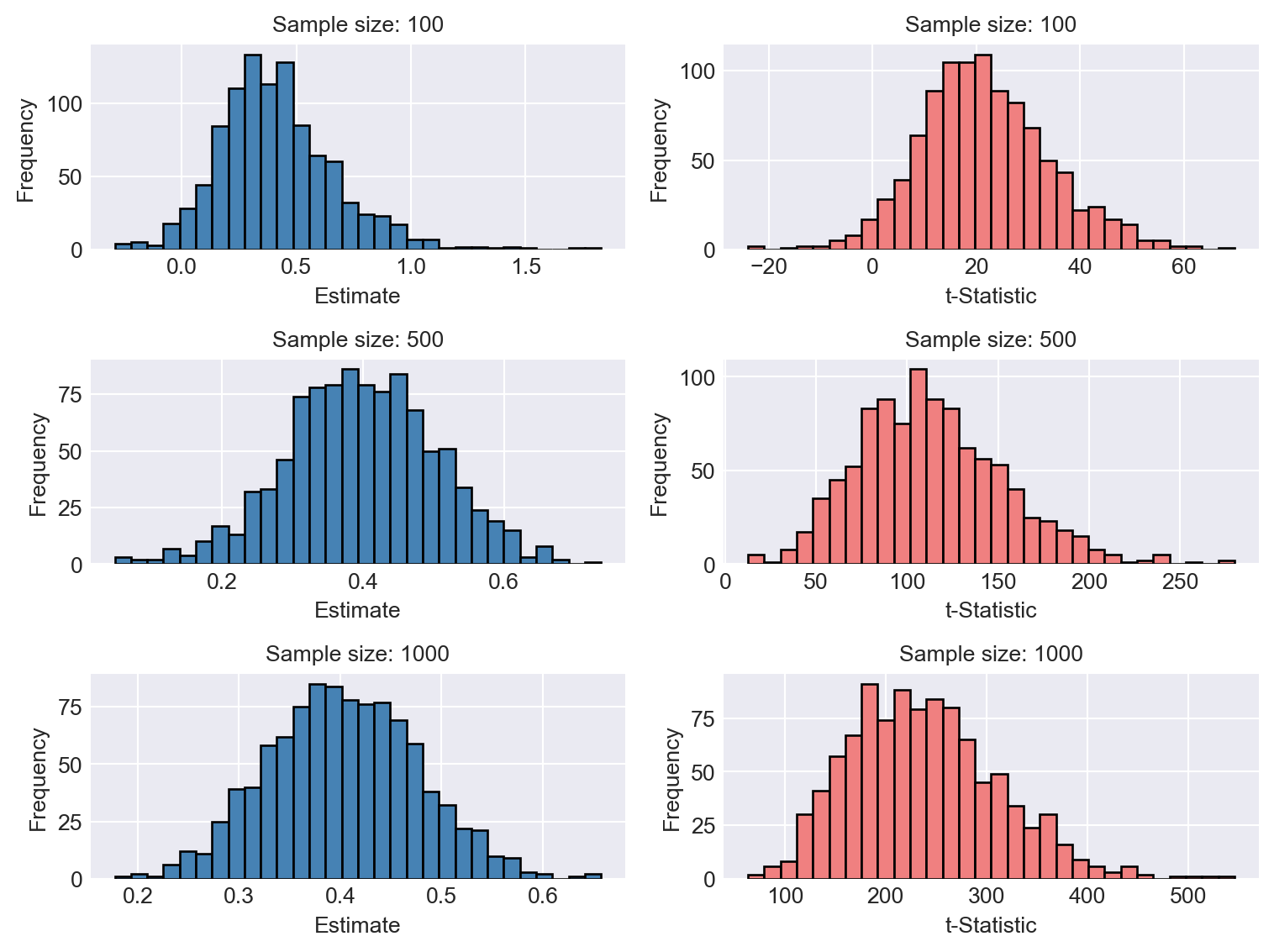

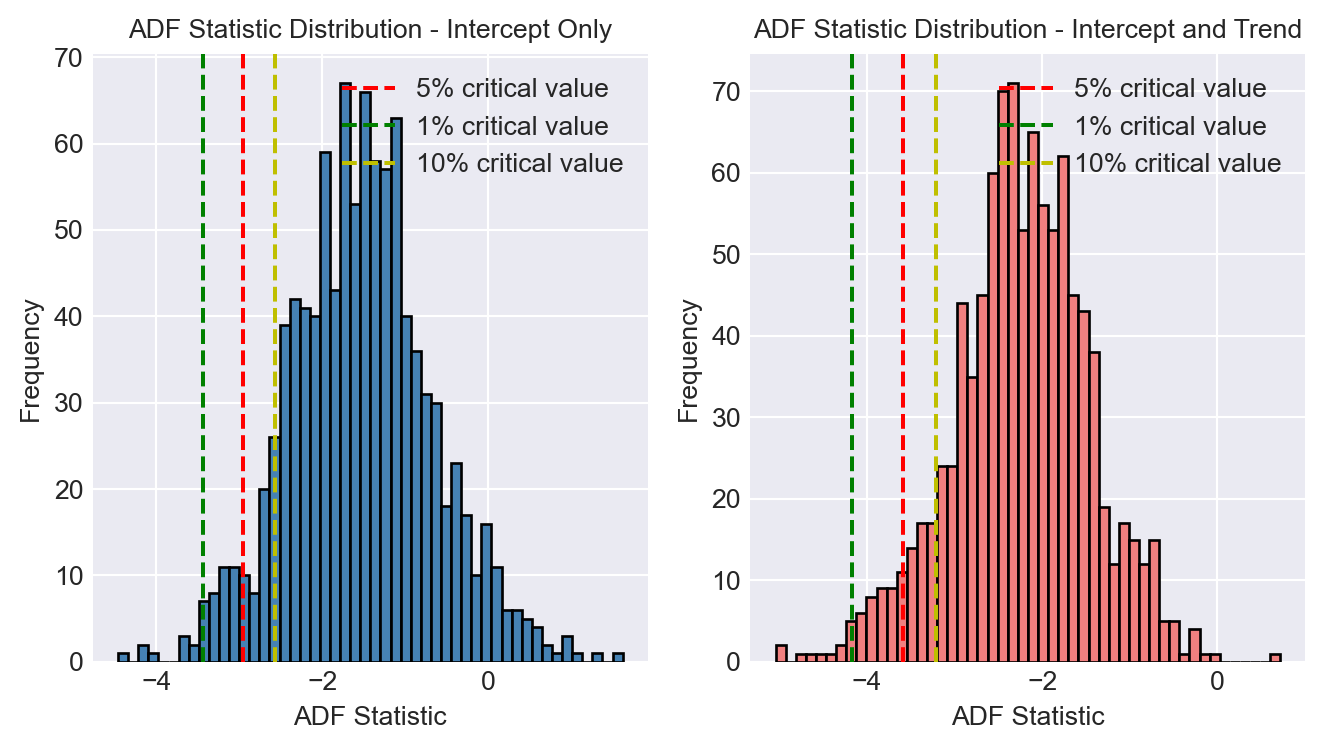

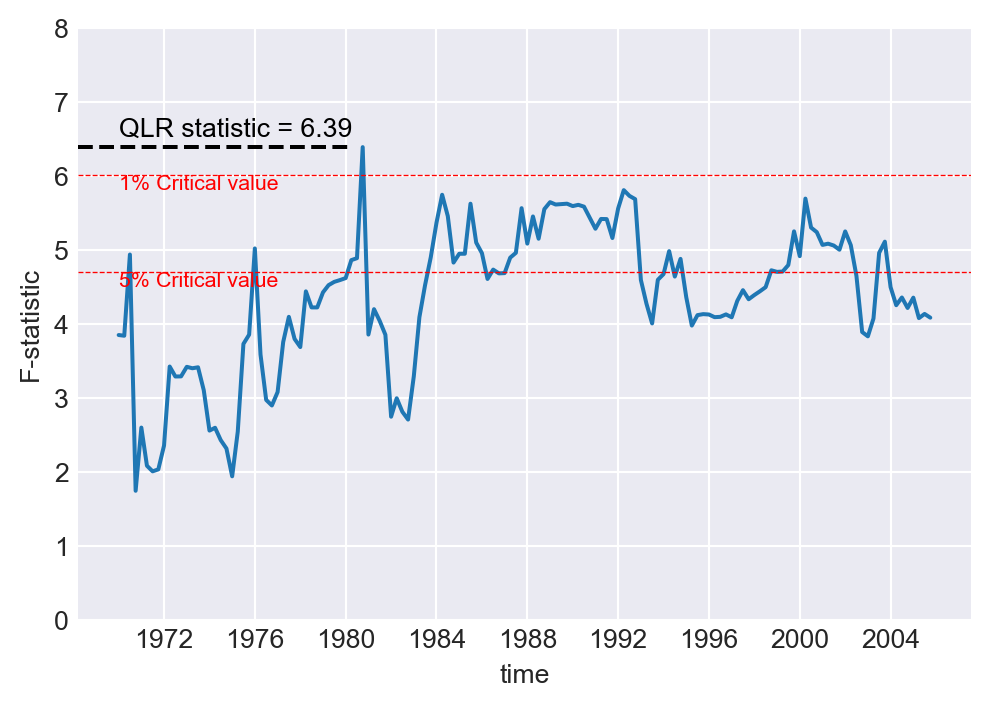

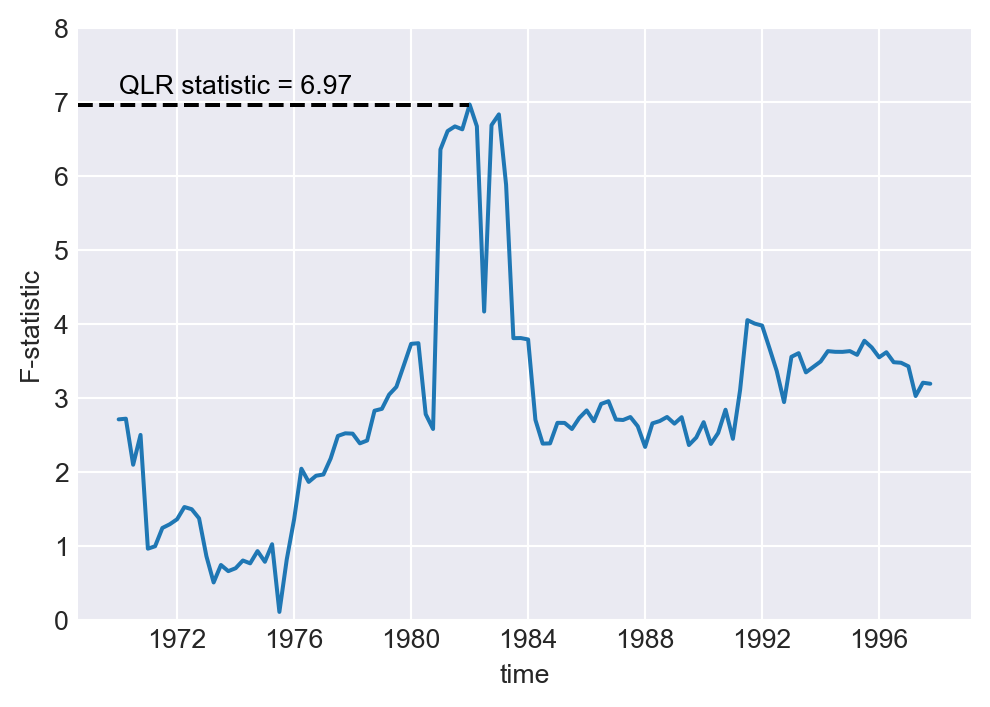

We begin by investigating the necessary and sufficient conditions under which the AR(\(1\)) model is weakly stationary. To this end, consider the following AR(\(1\)) process (with no intercept for simplicity): \[ Y_t = \beta_1 Y_{t-1} + u_t, \]